Mechanistic hypothesis and efficient market hypothesis Hudson Ltd had always classified interest paid as an operating cash

Question:

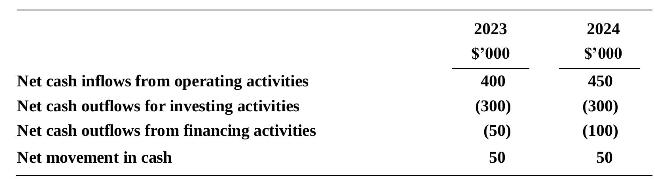

Mechanistic hypothesis and efficient market hypothesis Hudson Ltd had always classified interest paid as an operating cash flow. In 2024 Hudson Ltd changed its accounting policy and classified interest paid of \(\$ 50000\) as a financing cash flow in its statement of cash flows. The reported amounts are summarised below.

Required

1. Describe the mechanistic hypothesis. What does the mechanistic hypothesis predict about how investors and, therefore, share prices will respond to the increase in operating cash flows reported in Hudson Ltd's 2024 financial statements?

2. Describe the semi-strong form of market efficiency. What does the efficient market hypothesis predict about how investors and, therefore, share prices will respond to the increase in operating cash flows reported in Hudson Ltd's 2024 financial statements?

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes