Motu Ltd incurred an accounting loss of ($15) 120 for the year ended 30 June 2024. The

Question:

Motu Ltd incurred an accounting loss of \($15\) 120 for the year ended 30 June 2024. The current tax calculation determined that the company had incurred a tax loss of \($25\) 000.

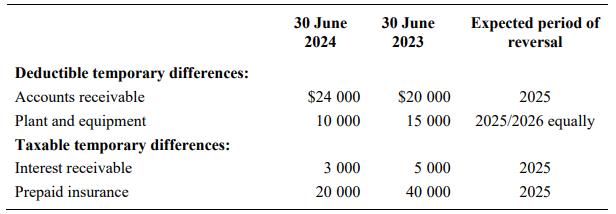

Tax legislation allows such losses to be carried forward and offset against future taxable profits. The company had the following temporary differences.

At 30 June 2023, Motu Ltd had recognised a deferred tax liability of \($13\) 500 and a deferred tax asset of \($10\) 500 with respect to temporary differences existing at that date.

No adjustment has yet been made for temporary differences existing at 30 June 2024.

Required

1. Discuss the factors that Motu Ltd should consider in determining the amount (if any)

to be recognised for deferred tax assets at 30 June 2024.

2. Calculate the amount (if any) to be recognised for deferred tax assets at 30 June 2024.

Justify your answer.

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes