Princeton Ltd provides a defined benefit superannuation plan for its managers. The assistant accountant has completed some

Question:

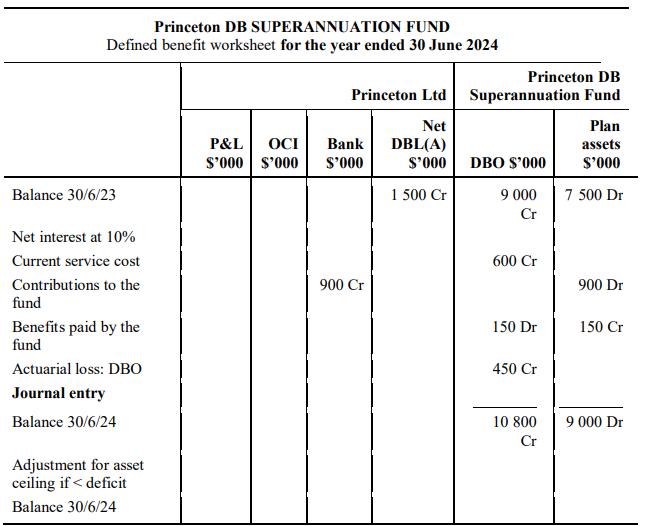

Princeton Ltd provides a defined benefit superannuation plan for its managers. The assistant accountant has completed some sections of the defined benefit worksheet based on information provided in an actuary’s report on the Princeton DB Superannuation Fund for the year ended 30 June 2024.

The asset ceiling was \($900\) 000 at 30 June 2024.

Required

1. Determine the surplus or deficit of the fund at 30 June 2024.

2. Determine the net defined benefit asset or liability at 30 June 2024.

3. Calculate the net interest and distinguish between the interest expense component of the defined benefit obligation and the interest income component of the change in the fair value of plan assets for the year ended 30 June 2024.

4. Determine the amount to be recognised in profit or loss in relation to the defined benefit superannuation plan for the year ended 30 June 2024.

5. Determine the amount to be recognised in other comprehensive income in relation to the defined benefit superannuation plan for the year ended 30 June 2024.

Step by Step Answer:

Financial Reporting

ISBN: 9780730396413

4th Edition

Authors: Janice Loftus, Ken Leo, Sorin Daniliuc, Belinda Luke, Hong Nee Ang, Mike Bradbury, Dean Hanlon, Noel Boys, Karyn Byrnes