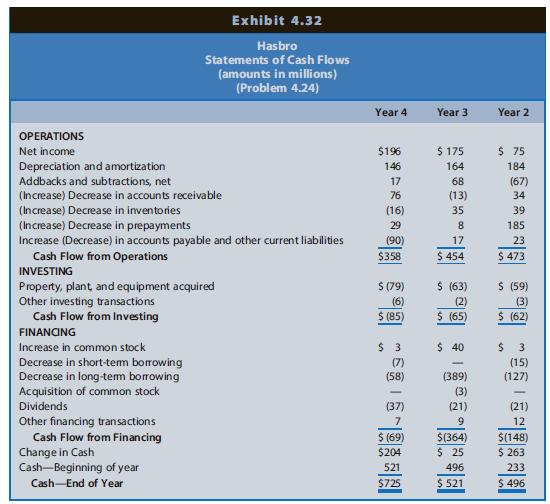

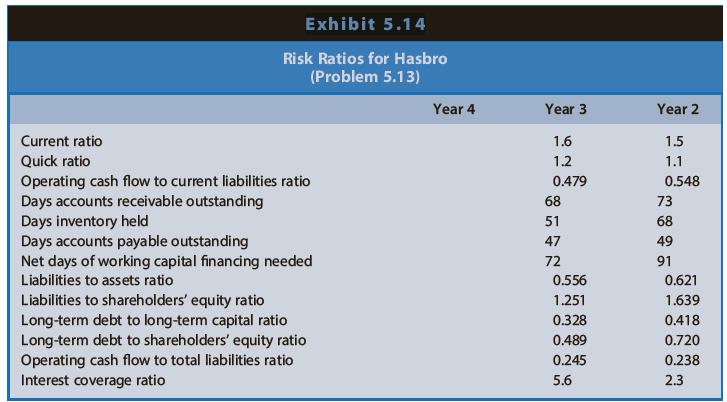

Refer to the financial statement data for Hasbro in Problem 4.24 in Chapter 4. Exhibit 5.14 presents

Question:

Refer to the financial statement data for Hasbro in Problem 4.24 in Chapter 4. Exhibit 5.14 presents risk ratios for Hasbro for Year 2 and Year 3.

Problem 4.24

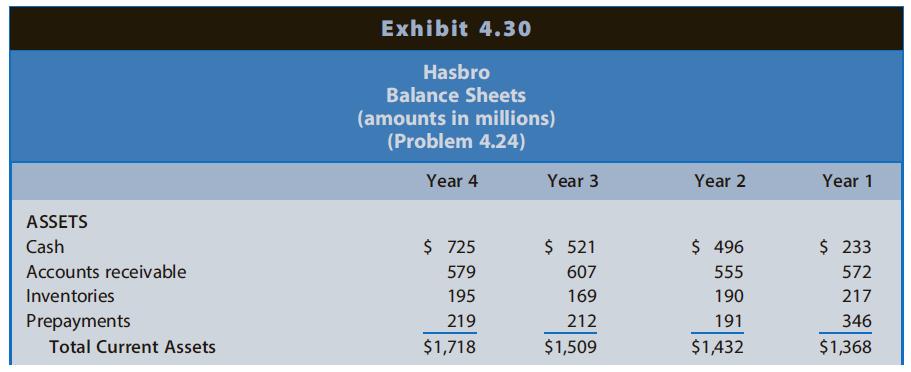

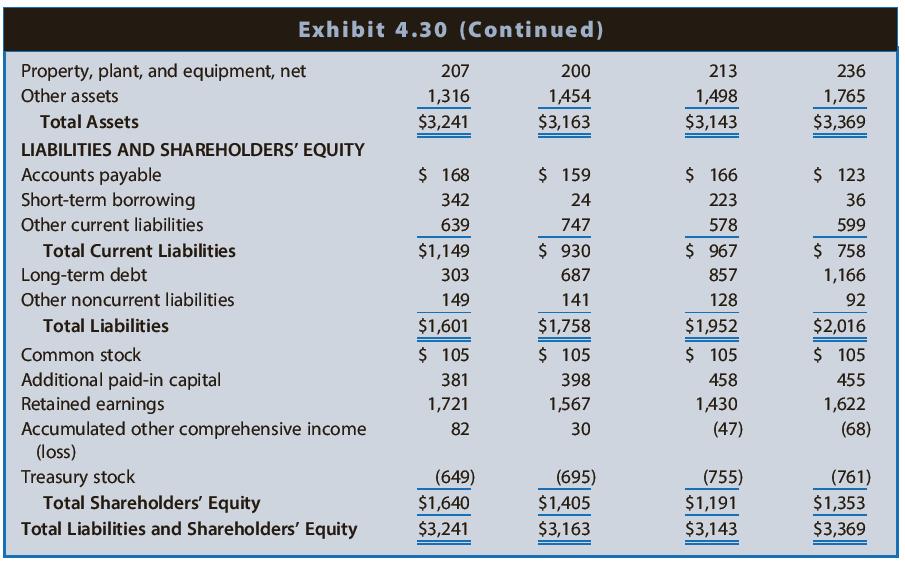

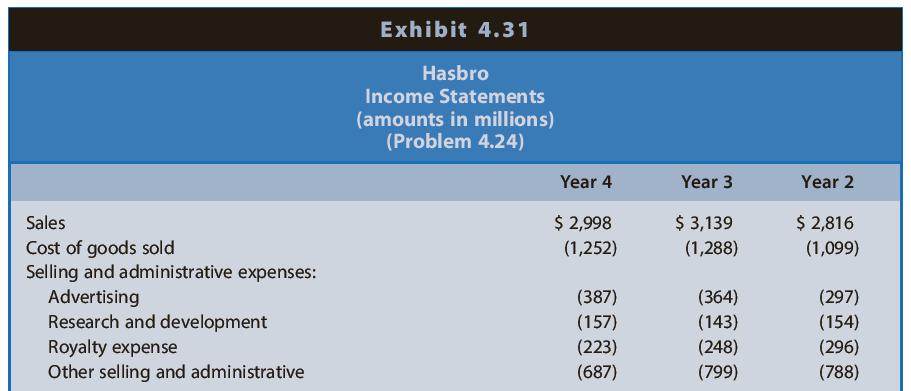

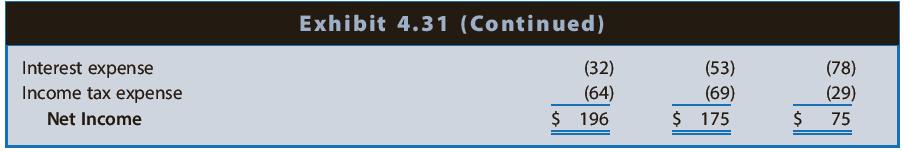

Calculating and Interpreting Profitability Ratios. Hasbro is a leading firm in the toy, game, and amusement industry. Its promoted brands group includes products from Playskool, Tonka, Milton Bradley, Parker Brothers, Tiger, and Wizards of the Coast. Sales of toys and games are highly variable from year to year depending on whether the latest products meet consumer interests. Hasbro also faces increasing competition from electronic and online games. Hasbro develops and promotes its core brands and manufactures and distributes products created by others under license arrangements. Hasbro pays a royalty to the creator of such products. In recent years, Hasbro has attempted to reduce its reliance on license arrangements, placing more emphasis on its core brands. Hasbro also has embarked on a strategy of reducing fixed selling and administrative costs in an effort to offset the negative effects on earnings of highly variable sales. Exhibit 4.30 presents the balance sheets for Hasbro for the years ended December 31, Years 1 through 4. Exhibit 4.31 presents the income statements and Exhibit 4.32 presents the statements of cash flows for Years 2 through 4.

REQUIRED

a. Calculate these ratios for Year 4.

b. Assess the changes in the short-term liquidity risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4.

c. Assess the changes in the long-term solvency risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4.

SolvencySolvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw