Since the early 1990s, woodstove sales have declined from 1,200,000 units per year to approximately 100,000 units

Question:

and (3) changes in consumers' lifestyles, particularly the growth of two-income families.

During this period of decline in industry sales, the market was flooded with woodstoves at distressed prices as companies closed their doors or liquidated inventories made obsolete by the new EPA regulations. Downward pricing pressure forced surviving companies to cut prices, output, or both. Years of contraction and pricing pressure left many of the surviving manufacturers in a precarious position financially, with excessive inventory, high debt, little cash, uncollectible receivables, and low margins.

The shakeout and consolidation among woodstove manufacturers and, to a lesser extent, woodstove specialty retailers have been dramatic. The number of manufacturers selling more than 2,000 units a year (characterized in the industry as ''large manufacturers'') has declined from approximately 90 to 35 in the prior 10 years. The number of manufacturers selling less than 2,000 units per year (characterized as ''small manufacturers'') has declined from approximately 130 to 6. Because the current woodstove market is not large enough to support all of the surviving producers, manufacturers have attempted to diversify in order to stay in business. Seeking relief, nearly all of the survivors have turned to the manufacture of gas appliances.

The Gas Appliance Market The gas appliance market includes three segments: (1) gas log sets, (2) gas fireplaces, and (3) gas stoves. Gas log sets are ''faux fires'' that can be installed in an existing fireplace. They are primarily decorative and have little heating value. Gas fireplaces are fully assembled fireboxes that a builder or contractor can install in new construction or in renovated buildings and houses. They are mainly decorative and are less expensive and easier to maintain than a masonry/brick fireplace. Gas stoves are freestanding appliances with a decorative appearance and efficient heating characteristics.

The first two segments of the gas appliance market (log sets and fireplaces) are large, established, stable markets. Established manufacturers control these markets, and distribution is primarily through mass merchandisers. The third segment (gas stoves) is less than five years old.

Although it is growing steadily, it has an annual volume of only about 100,000 units (almost identical to the annual volume of the woodstove market). This is the market to which woodstove manufacturers have turned for relief.

The gas stove market is not as heavily regulated as the woodstove market, and there are currently no EPA regulations governing the emissions of gas heating appliances. Gas stoves are perceived as being more appropriate for an aging population because they provide heat and ambiance but require no effort. They can be operated with a wall switch or thermostat or by remote control. Because actual fuel cost (or cost savings) is not an issue for many buyers, a big advantage of heating with wood is no longer a consideration for many consumers. Gas stoves are sold and distributed through mass merchandisers and through natural gas or propane dealers. The gas industry has the financial, promotional, organizational, and lobbying clout to support the development of the gas stove market, attributes that the tiny woodstove industry lacks.

Unfortunately, life has not been rosy for all of the woodstove companies entering this new market. Development costs and selling costs for new products using a different fuel and different distribution system have been substantial. Improvements in gas logs and gas burners have required rapid changes in product design. In contrast, woodstove designs are fairly stable and slow to change. Competition for market share has renewed pricing pressure on gas stove producers.

Companies trying to maintain their woodstove sales while introducing gas products must carry large inventories to service both product lines. Failure to forecast demand accurately has left many companies with inventory shortages during the selling season or with large inventories of unsold product at the end of the season.

Many surviving manufacturers who looked to gas stoves for salvation are now quietly looking for suitors to acquire them. A combination of excessive debt and inventory levels, together with high development and distribution costs, has made financial success highly uncertain. Continued consolidation will take place in this difficult market during the next five years.

Massachusetts Stove Company Massachusetts Stove Company (MSC) is one of the six ''small manufacturers'' to survive the EPA regulation and industry meltdown. The company has just completed its sixth consecutive year of slow but steady growth in revenue and profit since complying with the EPA regulations.

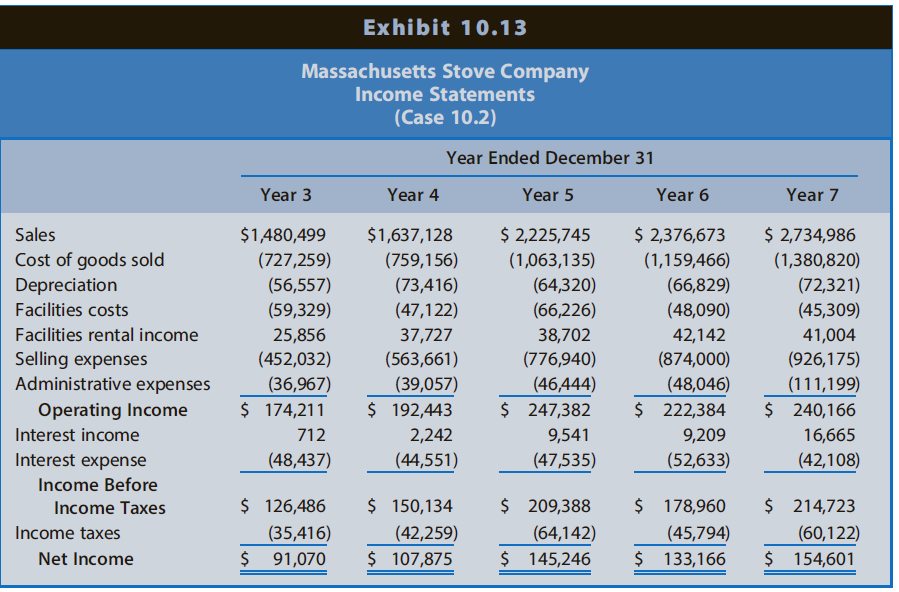

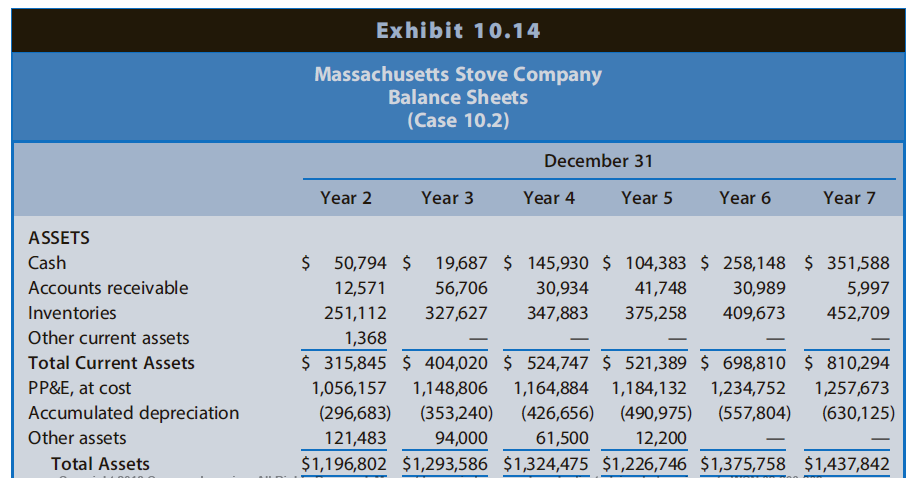

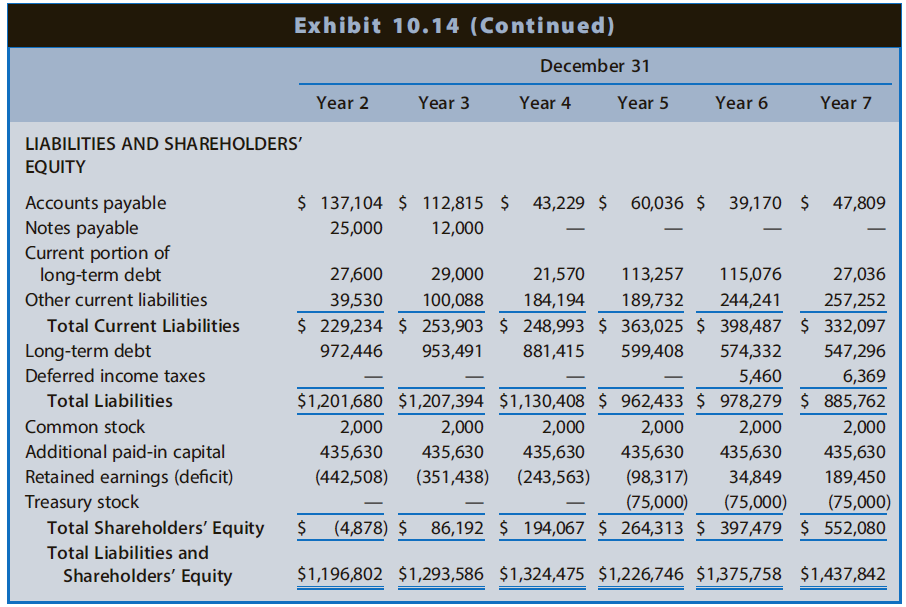

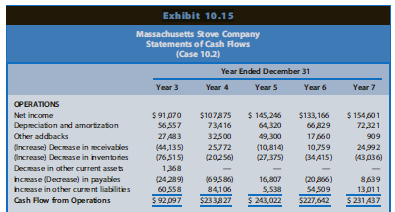

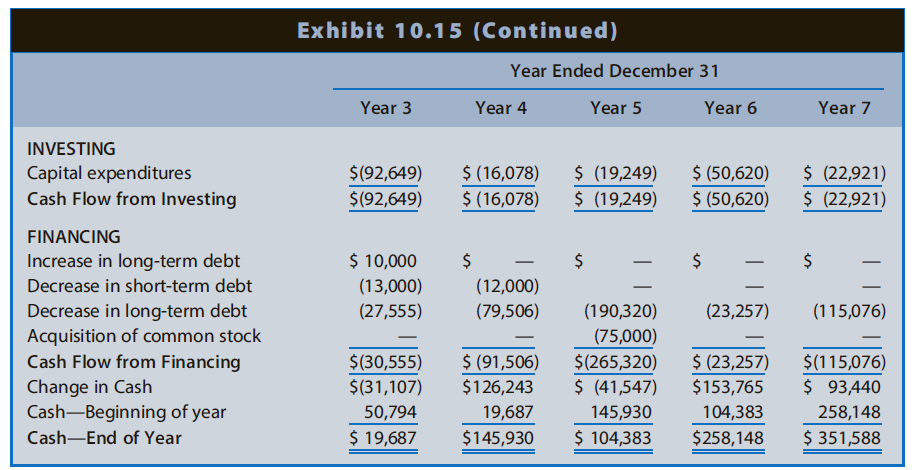

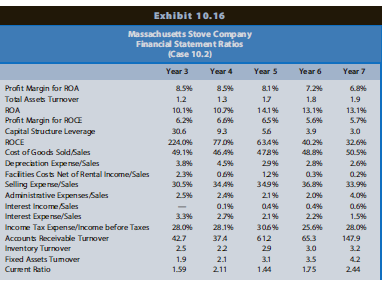

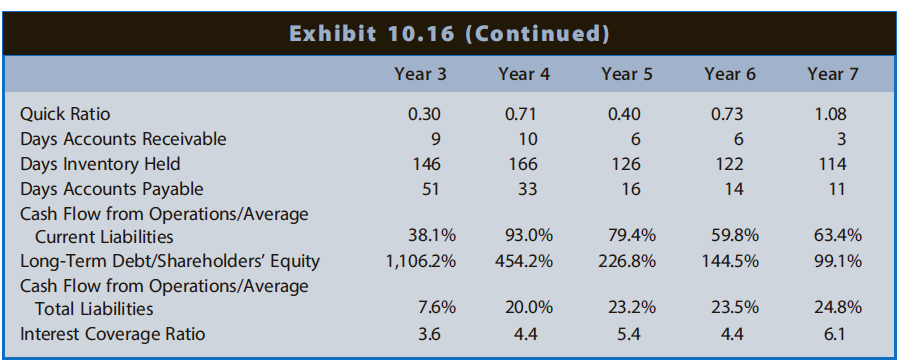

Exhibits 10.13-10.15 present the financial statements of MSC for Year 3-Year 7. Exhibit 10.16 (see page 719) presents selected financial statement ratios.

The success of MSC in recent years is a classic case of a company staying small, marketing in a specific niche, and vigorously applying a ''stick-to-your-knitting'' policy. MSC is the only woodstove producer that has not developed gas products; 100% of its sales currently come from woodstove sales. MSC is the only woodstove producer that sells by mail order directly to consumers. The mail-order market has sheltered MSC from some of the pricing pressure that other manufacturers have had to bear. The combination of high entry costs and high risks make it unlikely that another competitor will enter the mail-order niche.

MSC's other competitive advantages are the high efficiency and unique features of its woodstoves. MSC equips its woodstoves with a catalytic combuster, which re-burns gases emitted from burning wood. This re-burning not only increases the heat generated by the stoves, but also reduces pollutants in the air. MSC offers a woodstove with inlaid soapstone. This soapstone heats up and provides warmth even after the fire in the stove has dwindled. The soapstone also adds to the attractiveness of the stove as a piece of furniture. MSC's customer base includes many middle- and upper-income individuals.

MSC believes that profitable growth of woodstove sales beyond gross revenues of $3 million a year in the mail-order niche is unlikely. However, no one is selling gas appliances by mail order. Many of MSC's customers and prospects have asked whether MSC plans to produce a gas stove.

Management of MSC is contemplating the development of several gas appliances to sell by mail order. There are compelling reasons for MSC to do this, as well as some good reasons to be cautious.

Availability of Space MSC owns a 25,000-square-foot building but occupies only 15,000 square feet. MSC leases the remaining 10,000 square feet to two tenants. The tenants pay rent plus their share of insurance, property taxes, and maintenance costs. The addition of gas appliances to its product line would require MSC to use 5,000 square feet of the space currently rented to one of its tenants. MSC would have to give the tenant six months' notice to cancel its lease.

Availability of Capital MSC has its own internal funds for product development and inventory, as well as an unused line of credit. But it will lose interest income (or incur interest expense) if it invests these funds in development and increased inventory.

Existing Demand MSC receives approximately 50,000 requests for catalogs each year and has a mailing list of approximately 220,000 active prospects and 15,000 recent owners of woodstoves.

There is anecdotal evidence of sufficient demand so that MSC could introduce its gas stoves with little or no additional marketing expense, other than the cost of printing some additional catalog pages each year. MSC's management worries about the risk of the gas stove sales cannibalizing its existing woodstove sales. Also, if the current base of woodstove sales is eroded through mismanagement, inattention, or cannibalization, attempts to grow the business through expansion into gas appliances will be self-defeating.

Vacant Market Niche No other manufacturer is selling gas stoves by mail order. Because the entry costs are high and the unit volume is small, it is unlikely that another producer will enter the niche. MSC has had the mail-order market for woodstoves to itself for approximately seven years. MSC believes that this lack of existing competition will give it additional time to develop new products. However, management also believes that a timely entry will help solidify its position in this niche.

Suppliers MSC has existing relationships with many of the suppliers necessary to manufacture new gas products. The foundry that produces MSC's woodstove castings is one of the largest suppliers of gas heating appliances in central Europe. On the other hand, MSC would be a small, new customer for the vendors that provide the ceramic logs and gas burners. This could lead to problems with price, delivery, or service for these parts.

Synergies in Marketing and Manufacturing MSC would sell gas appliances through its existing direct-mail marketing efforts. It would incur additional marketing expenses for photography, printing, and customer service. MSC's existing plant is capable of manufacturing the shell of the gas units. It would require additional expertise to assemble fireboxes for the gas units (valves, burners, and log sets). MSC would have to increase its space and the number of employees to process and paint the metal parts of the new gas stoves. The gross margin for the gas products should be similar to that of the woodstoves.

Lack of Management Experience Managing new product development, larger production levels and inventories, and a more complex business would require MSC to hire more management expertise. MSC also would have to institute a new organizational structure for its more complex business and define responsibilities and accountability more carefully. Up to now, MSC has operated with a fairly loose organizational philosophy.

REQUIRED (additional requirements follow on page 723)

a. Identify clues from the financial statements and financial statement ratios for Year 3-Year 7 that might suggest that Massachusetts Stove Company is a mature business.

b. Design a spreadsheet for the preparation of projected income statements, balance sheets, and statements of cash flows for MSC for Year 8-Year 12. Also forecast the financial statements for each of these years under three scenarios: (1) best case, (2) most likely, and (3) worst case. The following sections describe the assumptions you can make.

Development Costs MSC plans to develop two gas stove models, but not concurrently. It will develop the first gas model during Year 8 and begin selling it during Year 9. It will develop the second gas model during Year 9 and begin selling it during Year 10. MSC will capitalize the development costs in the year incurred (Year 8 and Year 9) and amortize them straight-line over five years, beginning with the year the particular stove is initially sold (Year 9 and Year 10). Estimated development cost for each stove are as follows:

Best Case: $100,000 Most Likely Case: $120,000 Worst Case: $160,000 Capital Expenditures Capital expenditures, other than development costs, will be as follows:

Year 8, $20,000; Year 9, $30,000; Year 10, $30,000; Year 11, $25,000; Year 12, $25,000. Assume a six-year depreciable life, straight-line depreciation, and a full year of depreciation in the year of acquisition.

Sales Growth Changes in wood and gas stove sales relative to total sales of the preceding year are as follows:

Because sales of gas stoves will start at zero, the projections of sales should use the preceding growth rates in total sales. The growth rates shown for woodstove sales and gas stove sales simply indicate the components of the total sales increase.

Cost of Goods Sold Manufacturing costs of the gas stoves will equal 50% of sales, the same as for woodstoves.

Depreciation Depreciation will increase for the amortization of the product development costs on the gas stoves and depreciation of additional capital expenditures.

Facilities Rental Income and Facilities Costs Facilities rental income will decrease by 50% beginning in Year 9 when MSC takes over 5,000 square feet of its building now rented to another company and will remain at that reduced level for Year 10-Year 12. Facilities costs will increase by $30,000 beginning in Year 9 for facilities costs now paid by a tenant and for additional facilities costs required by gas stove manufacturing. These costs will remain at that increased level for Year 10-Year 12.

Selling Expenses Selling expenses as a percentage of sales are as follows:

Administrative Expenses Administrative expenses will increase by $30,000 in Year 8, $30,000 in Year 9, and $20,000 in Year 10, and then will remain at the Year 10 level in Years 11 and 12. Interest Income MSC will earn 5% interest on the average balance in cash each year. Interest Expense The interest rate on interest-bearing debt will be 6.8% on the average amount of debt outstanding each year. Income Tax Expense MSC is subject to an income tax rate of 28%.

Accounts Receivable and Inventories Accounts receivable and inventories will increase at the growth rate in sales.

Property, Plant, and Equipment Property, plant, and equipment at cost will increase each year by the amounts of capital expenditures and expenditures on development costs. Accumulated depreciation will increase each year by the amount of depreciation and amortization expense.

Accounts Payable and Other Current Liabilities Accounts payable will increase with the growth rate in inventories. Other current liabilities include primarily advances by customers for stoves manufactured soon after the year-end. Other current liabilities will increase with the growth rate in sales.

Current Portion of Long-Term Debt Scheduled repayments of long-term debt are as follows:

Year 8, $27,036; Year 9, $29,200; Year 10, $31,400; Year 11, $33,900; Year 12, $36,600; Year 13,

$39,500.

Deferred Income Taxes Deferred income taxes relate to the use of accelerated depreciation for tax purposes and the straight-line method for financial reporting. Assume that deferred income taxes will not change.

Shareholders' Equity Assume that there will be no changes in the contributed capital of MSC. Retained earnings will change each year in the amount of net income.

REQUIRED (continued from page 721)

c. Calculate the financial statement ratios listed in Exhibit 10.16 for MSC under each of the three scenarios for Year 8-Year 12.

Note: You should create a fourth spreadsheet as part of your preparation of the projected financial statements that will compute the financial ratios.

d. What advice would you give the management of MSC regarding its decision to enter the gas stove market? Your recommendation should consider the profitability and risks of this action as well as other factors you deem relevant.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Payable

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw