A life insurance company expects to make payments of $30,000,000 in one year, $15,000,000 in two years,

Question:

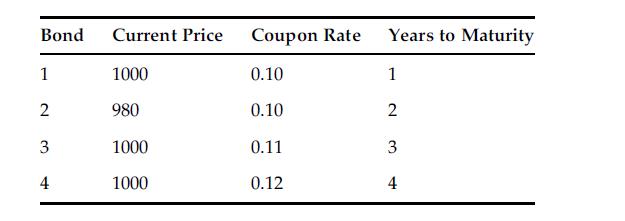

A life insurance company expects to make payments of $30,000,000 in one year, $15,000,000 in two years, $25,000,000 in three years, and $35,000,000 in four years to satisfy claims of policyholders. These anticipated cash flows are to be matched with a portfolio of the following $1000 face value bonds:

How many of each of the four bonds should the company purchase to exactly match its anticipated payments to policyholders?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: