A fixed-income analyst is considering the credit risk over the next year for three corporate bonds currently

Question:

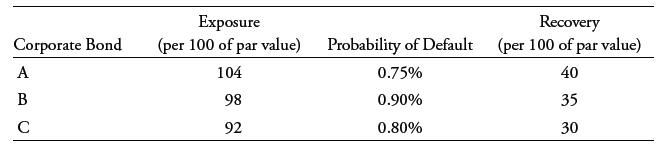

A fixed-income analyst is considering the credit risk over the next year for three corporate bonds currently held in her bond portfolio. Her assessment for the exposure, probability of default, and recovery is summarized in this table:

Although all three bonds have very similar yields to maturity, the differences in the exposures arise because of differences in their coupon rates. Based on these assumptions, how would she rank the three bonds, from highest to lowest, in terms of credit risk over the next year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: