A hedge fund specializes in investments in emerging market sovereign debt. The fund manager believes that the

Question:

A hedge fund specializes in investments in emerging market sovereign debt. The fund manager believes that the implied default probabilities are too high, which means that the bonds are viewed as “cheap” and the credit spreads are too high. The hedge fund plans to take a position on one of these available bonds.

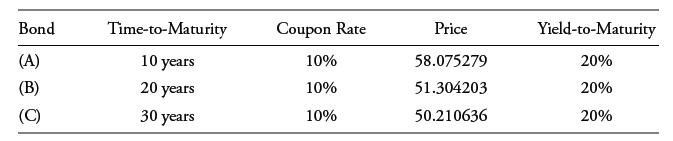

The coupon payments are annual. The yields-to-maturity are effective annual rates. The prices are per 100 of par value.

Compute the approximate modified duration of each of the three bonds using a 1 bp change in the yield-to-maturity and keeping precision to six decimals (because approximate duration statistics are very sensitive to rounding).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: