An analyst evaluates the following information relating to floating-rate notes (FRNs) issued at par value that have

Question:

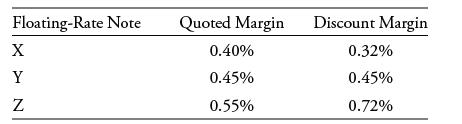

An analyst evaluates the following information relating to floating-rate notes (FRNs) issued at par value that have three-month MRR as a reference rate:

Based only on the information provided, the FRN that will be priced at a premium on the next reset date is:

A. FRN X.

B. FRN Y.

C. FRN Z.

Transcribed Image Text:

Floating-Rate Note X Y N Quoted Margin 0.40% 0.45% 0.55% Discount Margin 0.32% 0.45% 0.72%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

To determine which FRN will be priced at a premium on the next reset date we need to compare the quo...View the full answer

Answered By

Irfan Ali

I have a first class Accounting and Finance degree from a top university in the World. With 5+ years experience which spans mainly from the not for profit sector, I also have vast experience in preparing a full set of accounts for start-ups and small and medium-sized businesses. My name is Irfan Ali and I am seeking a wide range of opportunities ranging from bookkeeping, tax planning, business analysis, Content Writing, Statistic, Research Writing, financial accounting, and reporting.

4.70+

249+ Reviews

530+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

On january 15, 2019, Vern purchased the rights to a mineral interest for $2,500,000. At the time it was estimated that the recoverable units would be 500,000. During the year, 42,000 units were mined...

-

(a) What's the index of the top motif (approximately)? [3 points] (b) In the figure above, please highlight where the top motif. Draw a box around it on the top plot. [3 points] (e) What's the index...

-

The garden supply company is introducing various aged trees to their product range in 2021. They have provided the following information relating to its planned activities. Calculate the contribution...

-

Describe the impact of mobile computing upon your business and project its impact in the future. Do the same for social media. In both cases, when considering impacts, consider how each technology...

-

Define financial leverage. Explain how financial leverage works to the benefit of the common shareholders.

-

Bob is the owner and operator of a medium-sized grocery store that has been in his family for more than 40 years. Currently his business is flourishing, primarily because it has an established...

-

On February 20, 2009, Cedar Valley Aviation, a wholly owned subsidiary of Aerial Services, Inc. (ASI), brought a Piper 522AS (Cheyenne II) in for maintenance to Des Moines Flying Service, Inc....

-

Yello Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on January 1, 2014, at a cost of $148,000. Over its 4-year useful life, the bus is expected to be...

-

Assignment - Preschool YearsOverview The early childhood years are filled with many social and emotional developmental changes. Understanding the developmental theories in early childhood and...

-

A two-year floating-rate note pays six-month Libor plus 80 bps. The floater is priced at 97 per 100 of par value. The current six-month MRR is 1.00%. Assume a 30/360 day-count convention and evenly...

-

A bond with five years remaining until maturity is currently trading for 101 per 100 of par value. The bond offers a 6% coupon rate with interest paid semiannually. The bond is first callable in...

-

A 90% confidence interval for 1 2 using the sample results x 1 = 10.1, s 1 = 2.3, n 1 = 50 and x 2 = 12.4, s 2 = 5.7, n 2 = 50 Use the t-distribution to find a confidence interval for a difference...

-

1. Discuss the advantages and disadvantages of decentralization of a firm's operations. 2. What is the problem with using only financial measures of performance? 3. Why do managers analyze financial...

-

Describe Deloittes accounting information system, discuss the purpose of the accounting information system, explain the development process and maintenance of the accounting information system, list...

-

Write a event letter for Teacher's day celebration.

-

Increasing cost of cat food are potential WHAT when reviewing a SWOT analysis for a nonprofit cat rescue, external threat, internal threat, external weakness, or internal weakness?

-

What was the name of the first professional organization for HIM?

-

During August 2013, Tibbettss Casing Department equivalent unit product costs, computed under the weighted average method, were as follows: Transferred in ....... $ 10 Material .......... 2...

-

Data 9.2 on page 540 introduces the dataset Cereal, which includes information on the number of grams of fiber in a serving for 30 different breakfast cereals. The cereals come from three different...

-

Do wholesalers and retailers need to worry about new-product planning just as a producer needs to have an organized new-product development process? Explain your answer.

-

How do you think a retailer of Maytag washing machines would react if Maytag set up a website, sold direct to consumers, and shipped direct from its distribution center? Explain your thinking.

-

What risks do merchant wholesalers assume by taking title to goods? Is the size of this risk about constant for all merchant wholesalers?

-

Companies that are subject to legal sanctions and their management teams will be labeled as having a negative reputation. Public issues can enter the realm of law and have an impact on company...

-

Brooklyn Borough Hospital is examining its inpatient services to determine the year-to-year change in revenue. After examining the chart below, please answer the questions listed. 2022 Revenue...

-

What policies would you institute in your Hawaii law firm based on the Blair v. Ing decision? Blair v. Ing (2001) In this case, plaintiffs-appellants Leslie Blair and Laura Bishop (Plaintiffs) sued...

Study smarter with the SolutionInn App