An institutional client asks a fixed-income investment adviser to recommend a portfolio to immunize a single 10-year

Question:

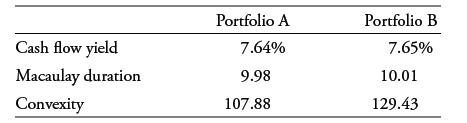

An institutional client asks a fixed-income investment adviser to recommend a portfolio to immunize a single 10-year liability. It is understood that the chosen portfolio will need to be rebalanced over time to maintain its target duration. The adviser proposes two portfolios of coupon-bearing government bonds because zero-coupon bonds are not available. The portfolios have the same market value. The institutional client’s objective is to minimize the variance in the realized rate of return over the 10-year horizon. The two portfolios have the following risk and return statistics:

These statistics are based on aggregating the interest and principal cash flows for the bonds that constitute the portfolios; they are not market value-weighted averages of the yields, durations, and convexities of the individual bonds. The cash flow yield is stated on a semi-annual bond basis, meaning an annual percentage rate having a periodicity of two; the Macaulay durations and convexities are annualized.

Indicate the portfolio that the investment adviser should recommend, and explain the reasoning.

Step by Step Answer: