Assume a hypothetical 30-year bond is issued on 15 August 2019 at a price of 98.195 (as

Question:

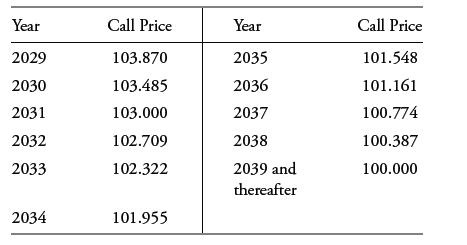

Assume a hypothetical 30-year bond is issued on 15 August 2019 at a price of 98.195 (as a percentage of par). Each bond has a par value of $1,000. The bond is callable in whole or in part every 15 August from 2029 at the option of the issuer. The call prices are shown below.

The call protection period is:

A. 10 years.

B. 11 years.

C. 20 years.

Transcribed Image Text:

Year 2029 2030 2031 2032 2033 2034 Call Price 103.870 103.485 103.000 102.709 102.322 101.955 Year 2035 2036 2037 2038 2039 and thereafter Call Price 101.548 101.161 100.774 100.387 100.000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

A is correct The bonds w...View the full answer

Answered By

Issa Shikuku

I have vast experience of four years in academic and content writing with quality understanding of APA, MLA, Harvard and Chicago formats. I am a dedicated tutor willing to hep prepare outlines, drafts or find sources in every way possible. I strive to make sure my clients follow assignment instructions and meet the rubric criteria by undertaking extensive research to develop perfect drafts and outlines. I do this by ensuring that i am always punctual and deliver quality work.

5.00+

6+ Reviews

13+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the following data collected from three independent populations. These data can also be found in the Excel file Prob 1828.xlsx. Perform a hypothesis test using α = 0.05 to...

-

In what manner can Walmart be elucidated, incorporating an analysis of its operational intricacies, firm-specific vulnerabilities, and distinctive attributes setting it apart from its industry...

-

Assume a hypothetical 30-year bond is issued on 15 August 2019 at a price of 98.195 (as a percentage of par). Each bond has a par value of $1,000. The bond is callable in whole or in part every 15...

-

Figure shows three rotating, uniform disks that are coupled by belts. One belt runs around the rims of disks A and C. Another belt runs around a central hub on disk A and the rim of disk B. The belts...

-

You are the auditor of Piedmore Corporation. You determine that the accounts receivable turnover has been much slower this period than in prior periods and that it is also materially lower than the...

-

Find the FSR, \(Q\), and \(F\) of the cavity shown as follows. Assume that the wavelength of light equals \(1 \mu \mathrm{m}\) and \(\alpha=\) \(0.001 \mathrm{~cm}^{-1}\). If we have a cavity with a...

-

Use the financial data for Randa Merchandising, Inc., in Exercise 13-13 to prepare its income statement for calendar-year 2017. (Ignore the earnings per share section.) Data From Exercise 13.13 In...

-

The Vest School of Vocational Technology has organized the school training programs into three departments. Each department provides training in a different area as follows: nursing assistant, dental...

-

Write a C program that asks the user to enter the sum and difference of 2 integer numbers. The program will find the 2 numbers and display them as shown below. Input validation: sum plus difference...

-

Floating-rate notes most likely pay: A. Annual coupons. B. Quarterly coupons. C. Semi-annual coupons.

-

Which of the following is not an example of an embedded option? A. Warrant B. Call provision C. Conversion provision

-

Fill in the blank with an appropriate word, phrase, or symbol(s). An expression that contains two terms in which each exponent that appears on a variable is a whole number is called a(n) __________ .

-

Write a function to generate the Fibonacci sequence up to a certain number of terms.

-

Find the solutions: 2 a. 3 2 X= 2 -1 10 327 5 3 1 7 b. X- 1 -3-2 = 8 -5 2 C. 4 5 2 X. 5-7 3 9 7 6 112 111 2 0 18 12 9 23 15 11 Hint: A AA-A- = I -8 3 0 -5 9 0 15 0

-

How to create trial balance for the following Cash 236,950 R. Gonzales Capital 200,000 Office Equipment 36,500 Notes Payable 10,950 Office Supplies 1,000 Prepaid Rent 10,500 Advertising Expense 5,000...

-

1.Explain the economic problem in farm management. 2.Discuss the distinguishing features of farming as a business. 3.Financing of farming is more risky as compared to other industries. 4.Explain the...

-

What is the output of the following code? int a = 3; int b = 5; int c = 8; if (a > 0 && b < c 1 c > 8) { System.out.println("true"); } else { } System.out.println("false");

-

Describe a cybernetic control system.

-

An Atomic Energy Commission nuclear facility was established in Hanford, Washington, in 1943. Over the years, a significant amount of strontium 90 and cesium 137 leaked into the Columbia River. In a...

-

One organization that all students will have some knowledge about is their own college or university. What are the strengths, weaknesses, opportunities, and threats that you see facing your college...

-

Suppose a nonprofit organization's strategy requires that it phase out a program on which few people rely, but those people are vulnerable and no good substitute exists. How might the organization...

-

Select an organization that you know wellmaybe you work there, have been a volunteer, or just follow it on Twitter. What do you think is the organizations strategy, as that term is discussed in this...

-

USCo, a US corporation, owns 60% of the stock of FSub1, a foreign corporation. In its first year, FSub1 has $100 of foreign personal holding company income, on which it paid foreign income tax of...

-

Ed's Veggies is thinking about launching its new Eggplant Wrap, knowing that the new product will compete with the chain's own Salsa Veggie Wrap. Introducing the Eggplant Wrap will involve fixed...

-

3. A wheel of radius 2.4 meters on a fixed axis can rotate freely and has a rope wrapped several times around it. The rope is pulled with a velocity v so that the wheel rotates. At a particular...

Study smarter with the SolutionInn App