Based on Exhibits 57, in comparison to Company X, Company Y has a higher: A. Debt/capital. B.

Question:

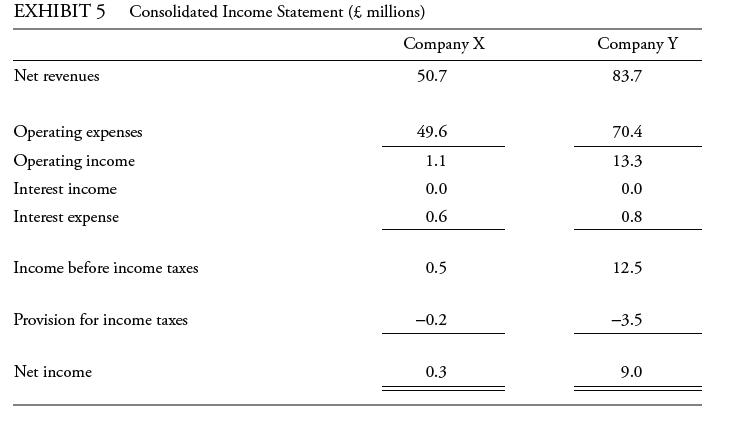

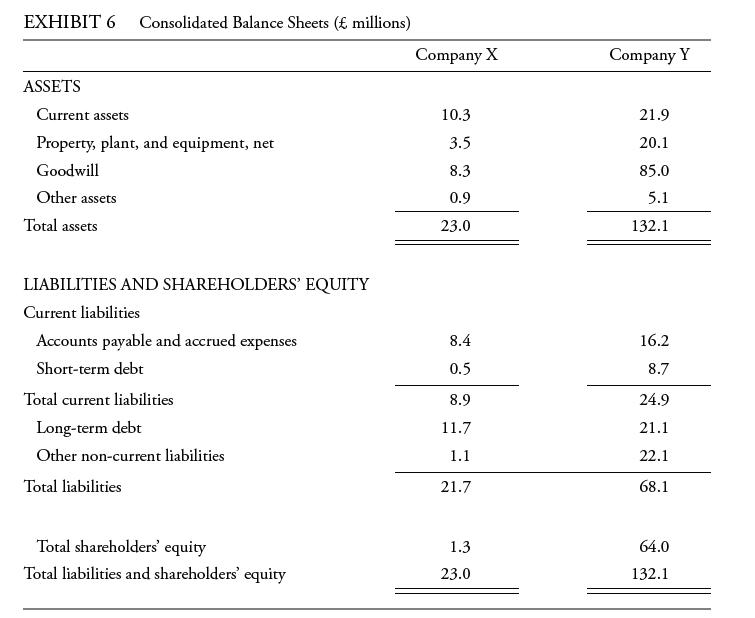

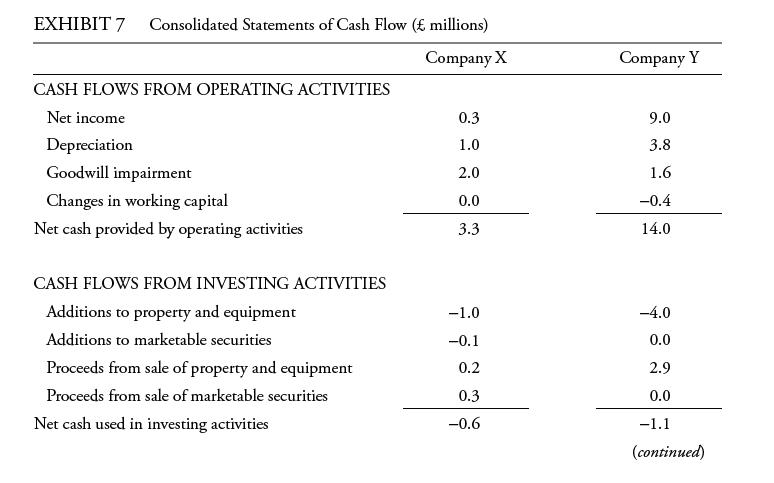

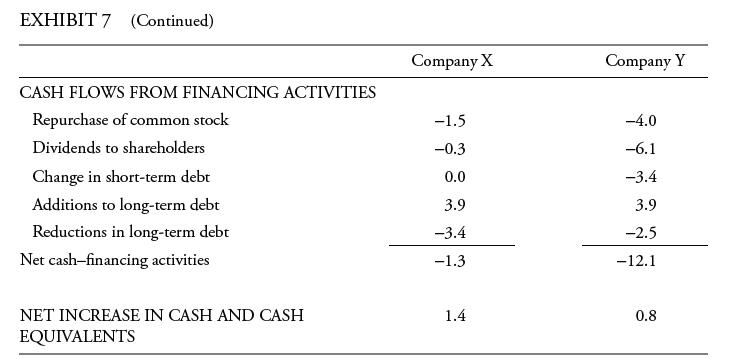

Based on Exhibits 5−7, in comparison to Company X, Company Y has a higher:

A. Debt/capital.

B. Debt/EBITDA.

C. Free cash flow after dividends/debt.

The following information relates

Transcribed Image Text:

EXHIBIT 5 Consolidated Income Statement (£ millions) Net revenues Operating expenses Operating income Interest income Interest expense Income before income taxes Provision for income taxes Net income Company X 50.7 49.6 1.1 0.0 0.6 0.5 -0.2 0.3 Company Y 83.7 70.4 13.3 0.0 0.8 12.5 -3.5 9.0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Based on Exhibits 57, in comparison to Company Y, Company X has greater: A. Leverage. B. Interest coverage. C. Operating profit margin. The following information relates EXHIBIT 5 Consolidated Income...

-

The following information relates to Costco Wholesale Corporation and Wal-Mart Stores, Inc., for their 2012 and 2011 fiscal years. Required a. Compute the following ratios for the companies 2012...

-

The following information relates to Dell City, whose first fiscal year ended December 31, 2019. Assume Dell has only the long-term debt as specified below and only the funds necessitated by the...

-

(a) For a fiber-reinforced composite, the efficiency of reinforcement ? is dependent on fiber length l according to where x represents the length of the fiber at each end that does not contribute to...

-

The following financial information is for A. Galler Company for 2009, 2008, and 2007: Required a. For 2009, 2008, and 2007, determine the following: 1. Return on assets (using end-of-year total...

-

The temperature of a liquid stream in a heat exchanger is determined by thermocouples as shown in Figure P13.20. One thermocouple is attached to the tube wall and it measures a temperature of \(300...

-

Demonstrate the links among cost estimation, the WBS, and the project schedule.

-

Metters Cabinets, Inc., needs to choose a production method for its new office shelf, the Maxistand. To help accomplish this, the firm has gathered the following production cost data: Metters...

-

From 2016 and 2017, what accounts for the high ratios of Goodwill to total assets (over 30%) for the following companies: United Healthcare, Proctor and Gamble, and Pfizer? On the other hand, why is...

-

Which of the following accounting issues should mostly likely be considered a character warning flag in credit analysis? A. Expensing items immediately B. Changing auditors infrequently C....

-

When determining the capacity of a borrower to service debt, a credit analyst should begin with an examination of: A. Industry structure. B. Industry fundamentals. C. Company fundamentals.

-

What is the Sarbanes-Oxley Act?

-

Consider whether data distribution skewness exists in some of the numeric variables, and if it does, determine how to transform the data into a less skewed distribution. Perform data sub-setting and...

-

Depending on which of Exercises 7 through 12 you have completed, determine the overall factor of safety of one or more of the following structures. Assume steel members with a yield strength of S Y =...

-

In 2009, the inflation rate reached negative 0.4 percent while the unemployment rate hit 10 percent. If the target inflation rate was 2 percent and the full-employment rate of unemployment was 5...

-

Depending on which of Exercises 7 through 12 you have completed, determine the required crosssectional areas of the members comprising one or more of the following structures. Assume steel members...

-

UniCom produces a wide range of consumer electronics. UniComs Newark, New York, plant produces two types of cordless phones: 2.4 GHz and 6.0 GHz. The following table summarizes operations at the...

-

Multiple Choice Questions: 1. The usual penalty in a civil case is: a. Monetary damages. b. Imprisonment. c. Equitable relief. d. Any of the above. e. Only a and c. 2. The burden of proof in a...

-

What is the difference between the straight-line method of depreciation and the written down value method? Which method is more appropriate for reporting earnings?

-

What are transferred-in costs?

-

Why is it likely that Wrigley uses a process costing system rather than a job costing system?

-

Explain the difference between physical units and equivalent units.

-

UNIFOR service collective agreement UNIFOR tech collective agreement Take this two collective agreement and review the articles under scheduling, hours of work and vacation scheduling. Identify the...

-

Why was the rate of inflation in the uk relatively low in the 1950's? Explain 4 policies that occurred in the UK that helped inflation to be low.

-

4. A soil sample is under a biaxial state of stress. 8, while on plane 2 they are = 11.6, t = -4. major and minor principal stresses. On plane 1 the stresses are = 26, t = Draw the Mohr's Circle and...

Study smarter with the SolutionInn App