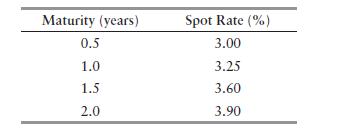

Consider the following hypothetical spot curve to two years: Use these spot rates to price a 4%

Question:

Consider the following hypothetical spot curve to two years:

Use these spot rates to price a 4% coupon, 2-year notes and answer the following questions.

a. What is the yield to maturity of the note?

b. What is the market-value-weighted yield of a portfolio of zero-coupon bonds with identical cash flows that replicates the 2-year note?

Assume there is no arbitrage.

c. How should the portfolio yield be computed?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Fixed Income Analytics

ISBN: 9780470572139

2nd Edition

Authors: Steven V. Mann, Frank J. Fabozzi

Question Posted: