Keisha Jones is a junior analyst at Sparling Capital. Julie Anderson, a senior partner and Joness manager,

Question:

Keisha Jones is a junior analyst at Sparling Capital. Julie Anderson, a senior partner and Jones’s manager, meets with Jones to discuss interest rate models used for the firm’s fixed-income portfolio.

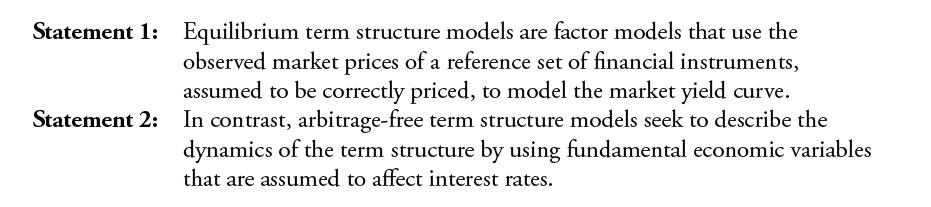

Anderson begins the meeting by asking Jones to describe features of equilibrium and arbitrage- free term structure models. Jones responds by making the following statements:

Anderson then asks Jones about her preferences concerning term structure models. Jones states:

I prefer arbitrage-free models. Even though equilibrium models require fewer parameters to be estimated relative to arbitrage-free models, arbitrage-free models allow for time-varying parameters. In general, this allowance leads to arbitrage-free models being able to model the market yield curve more precisely than equilibrium models.

Is Jones correct in describing key differences in equilibrium and arbitrage-free models as they relate to the number of parameters and model accuracy?

A. Yes

B. No, she is incorrect about which type of model requires fewer parameter estimates.

C. No, she is incorrect about which type of model is more precise at modeling market yield curves.

Step by Step Answer: