Mallinckrodt PLC (Mallinckrodt) is an Ireland-incorporated specialty pharmaceutical company. As a credit analyst, you have been asked

Question:

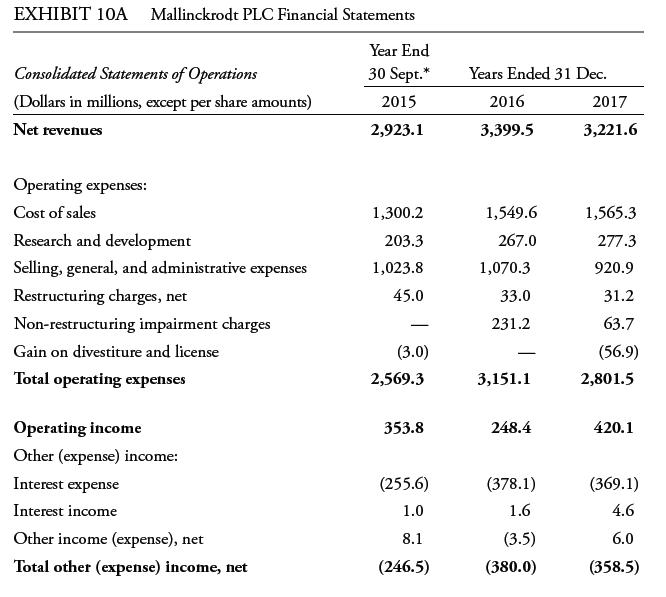

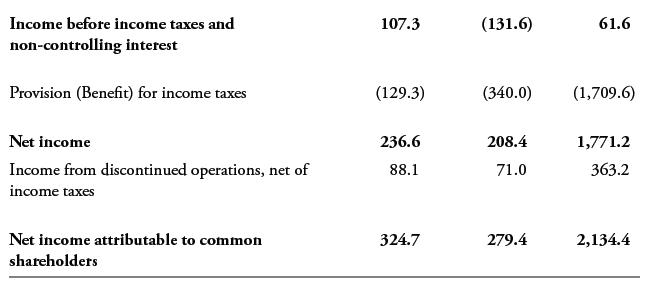

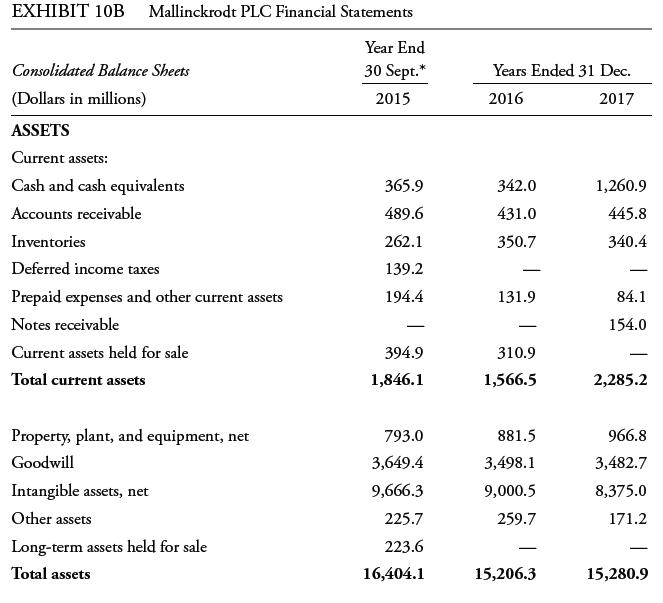

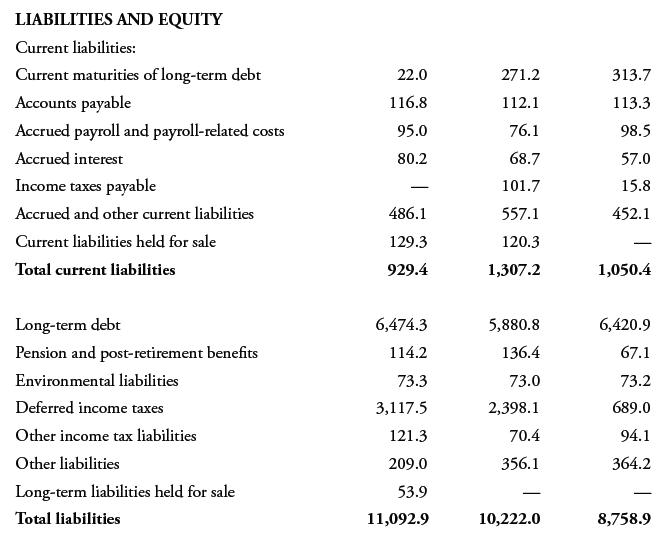

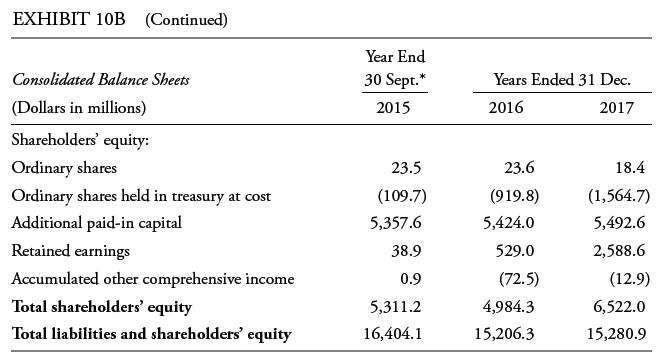

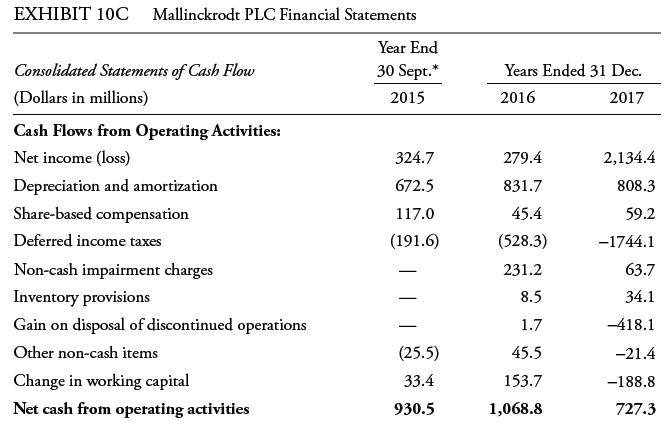

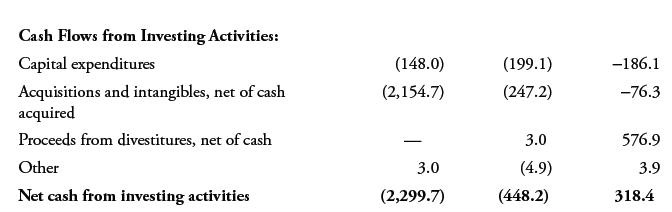

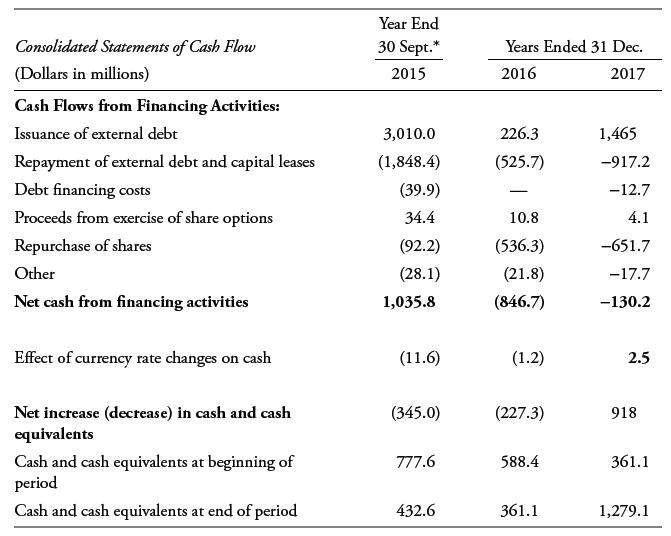

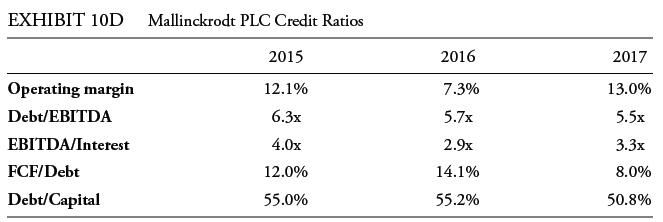

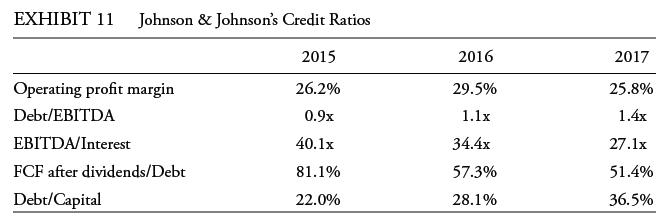

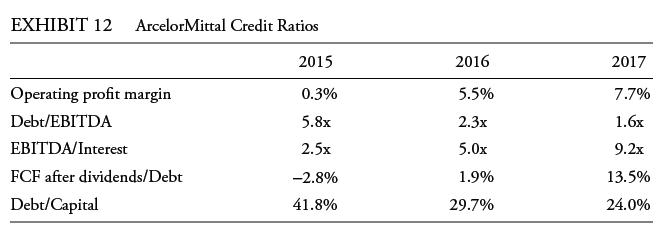

Mallinckrodt PLC (Mallinckrodt) is an Ireland-incorporated specialty pharmaceutical company. As a credit analyst, you have been asked to assess its creditworthiness—on its own, compared to a competitor in its overall industry, and compared with a similarly rated company in a different industry. Using the financial statements provided in Exhibits 10 through 12 for the three years ending 31 December 2015, 2016, and 2017, address the following:

1. Calculate Mallinckrodt’s operating profit margin, EBITDA, and free cash flow after dividends. Comment on what these measures indicate about Mallinckrodt’s profitability and cash flow.

2. Determine Mallinckrodt’s leverage ratios: debt/EBITDA, debt/capital, free cash flow after dividends/debt. Comment on what these leverage ratios indicate about Mallinckrodt’s creditworthiness.

3. Calculate Mallinckrodt’s interest coverage using both EBIT and EBITDA. Comment on what these coverage ratios indicate about Mallinckrodt’s creditworthiness.

4. Using the credit ratios provided in Exhibit 11 on Johnson & Johnson, compare the creditworthiness of Mallinckrodt relative to Johnson & Johnson.

5. Compare the Exhibit 12 credit ratios of Luxembourg-based ArcelorMittal, one of the world’s largest global steelmakers, with those of Mallinckrodt. Comment on the volatility of the credit ratios of the two companies. Which company looks to be more cyclical? What industry factors might explain some of the differences? In comparing the creditworthiness of these two companies, what other factors might be considered to offset greater volatility of credit ratios?

Step by Step Answer: