Robert Jourdan, a portfolio manager, has just valued a 7% annual coupon bond that was issued by

Question:

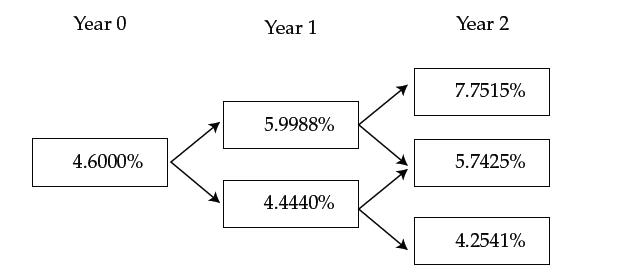

Robert Jourdan, a portfolio manager, has just valued a 7% annual coupon bond that was issued by a French company and has three years remaining until maturity. The bond is callable at par one year and two years from now. In his valuation, Jourdan used the yield curve based on the on-the-run French government bonds. The one-year, two-year, and three-year par rates are 4.600%, 4.900%, and 5.200%, respectively. Based on an estimated interest rate volatility of 15%, Jourdan constructed the following binomial interest rate tree:

Jourdan valued the callable bond at 102.294% of par. However, Jourdan’s colleague points out that because the corporate bond is riskier than French government bonds, the valuation should be performed using an OAS of 200 bps.

Holding the price calculated in the previous question, the OAS for the callable bond at 20% volatility will be:

A. Lower.

B. The same.

C. Higher.

Step by Step Answer: