Sidley Brown, a fixed-income associate at KMR Capital, is analyzing the effect of interest rate volatility on

Question:

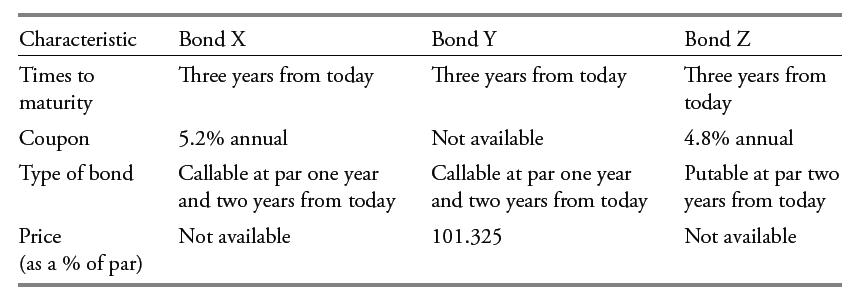

Sidley Brown, a fixed-income associate at KMR Capital, is analyzing the effect of interest rate volatility on the values of callable and putable bonds issued by Weather Analytics (WA). WA is owned by the sovereign government, so its bonds are considered default free. Brown is currently looking at three of WA’s bonds and has gathered the following information about them:

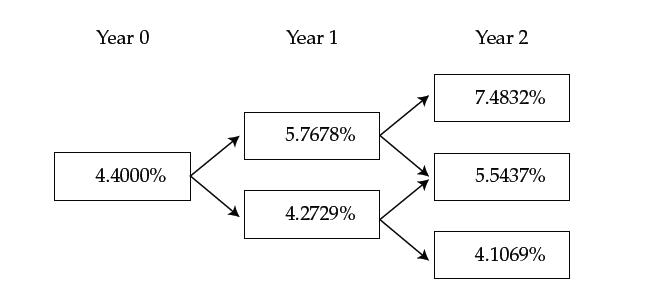

The one-year, two-year, and three-year par rates are 4.400%, 4.700%, and 5.000%, respectively. Based on an estimated interest rate volatility of 15%, Brown has constructed the following binomial interest rate tree:

The coupon rate of Bond Y is closest to:

A. 4.200%.

B. 5.000%.

C. 6.000%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: