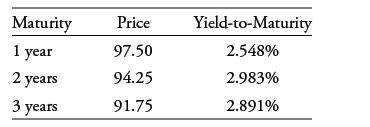

Suppose that an investor observes the following prices and yields-to-maturity on zerocoupon government bonds: The prices are

Question:

Suppose that an investor observes the following prices and yields-to-maturity on zerocoupon government bonds:

The prices are per 100 of par value. The yields-to-maturity are stated on a semiannual bond basis.

The investor has a three-year investment horizon and is choosing between (1) buying the two-year zero and reinvesting in another one-year zero in two years and (2) buying and holding to maturity the three-year zero. The investor decides to buy the two-year bond. Based on this decision, which of the following is the minimum yield-to-maturity the investor expects on one-year zeros two years from now?

A. 2.548%

B. 2.707%

C. 2.983%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: