The following information is from the prospectus supplement for US$877,670,000 of auto loan ABS issued by XYZ

Question:

The following information is from the prospectus supplement for US$877,670,000 of auto loan ABS issued by XYZ Credit Automobile Receivables Trust 2019:

The collateral for this securitization is a pool of subprime automobile loan contracts secured for new and used automobiles and light-duty trucks and vans.

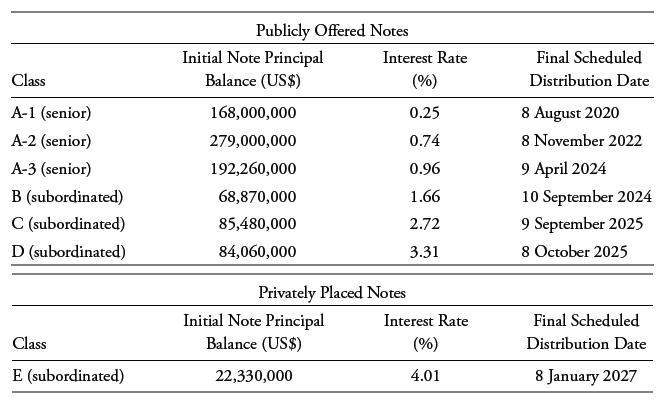

The issuing entity will issue seven sequential-pay classes of asset-backed notes pursuant to the indenture. The notes are designated as the “Class A-1 Notes,” the “Class A-2 Notes,” the “Class A-3 Notes,” the “Class B Notes,” the “Class C Notes,” the “Class D Notes,” and the “Class E Notes.” The Class A-1 Notes, the Class A-2 Notes, and the Class A-3 Notes are the “Class A Notes.” The Class A Notes, the Class B Notes, the Class C Notes, and the Class D Notes are being offered by this prospectus supplement and are sometimes referred to as the publicly offered notes. The Class E Notes are not being offered by this prospectus supplement and will initially be retained by the depositor or an affiliate of the depositor. The Class E Notes are sometimes referred to as the privately placed notes.

Each class of notes will have the initial note principal balance, interest rate, and final scheduled distribution date listed in the following tables:

Interest on each class of notes will accrue during each interest period at the applicable interest rate.

The overcollateralization amount represents the amount by which the aggregate principal balance of the automobile loan contracts exceeds the principal balance of the notes. On the closing date, the initial amount of overcollateralization is approximately US$49,868,074, or 5.25% of the aggregate principal balance of the automobile loan contracts as of the cutoff date.

On the closing date, 2.0% of the expected initial aggregate principal balance of the automobile loan contracts will be deposited into the reserve account, which is approximately US$18,997,361.

The reference to subprime meant that:

A. The asset-backed notes were rated below investment grade.

B. The automobile (auto) loan contracts were made to borrowers who did not have or could not document strong credit.

C. Some of the auto loan contracts were secured by autos of low quality that may have been difficult to sell in case the borrower defaults.

Step by Step Answer: