Excess capacity Krogh Lumbers 2005 financial statements are shown here. a. Assume that the company was operating

Question:

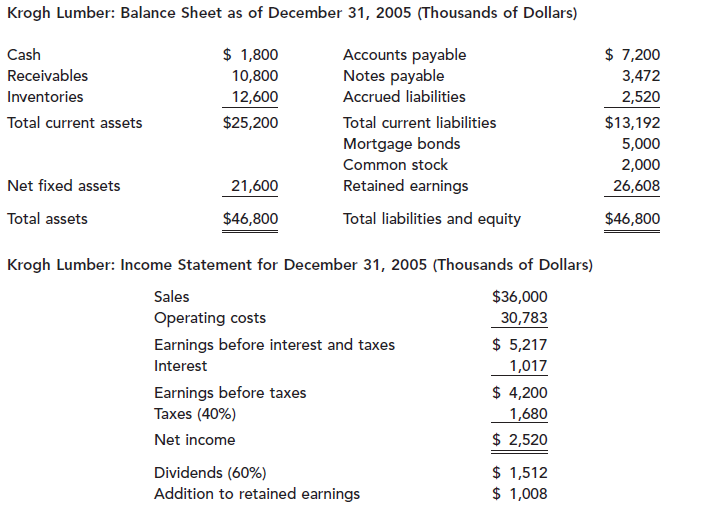

Excess capacity Krogh Lumber’s 2005 financial statements are shown here.

a. Assume that the company was operating at full capacity in 2005 with regard to all items except fixed assets; fixed assets in 2005 were being utilized to only 75 percent of capacity. By what percentage could 2006 sales increase over 2005 sales without the need for an increase in fixed assets?

b. Now suppose 2006 sales increase by 25 percent over 2005 sales. How much additional external capital will be required? Assume that Krogh cannot sell any fixed assets. Assume that any required financing is borrowed as notes payable. Use a pro forma income statement to determine the addition to retained earnings.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Fundamentals of Financial Management

ISBN: 978-0324302691

11th edition

Authors: Eugene F. Brigham, Joel F. Houston