Given the following information, calculate the weighted average cost of capital for Hadley Corporation. Line up the

Question:

Percent of capital structure:

Preferred stock .......................................10%

Common equity ...... . .. .. .. ........ .. . .. . .60

Debt ........................... ............................30

Additional information:

Corporate tax rate ......................... ........34%

Dividend, preferred.............................$9.00

Dividend, expected common ....... .. . .$3.50

Price, preferred .................... .. ... . .$102.00

Corporate growth rate .... . . ....... .. .. .. . .6%

Bond yield ....................... . ... . ........... . .7%

Flotation cost, preferred ........... .. . .$ 3.20

Price, common ..................................$70.00

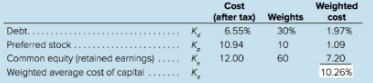

Table 11.1

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta