John Churchill, instead of taking a job with a large company on graduation, had started his own

Question:

The first Churchill's opened in Toronto in 2009. Because Churchill's family had owned a bakery, he had grown up in the old-style bakery business and was aware that it was a dying industry. On the other hand, his summer work for the bakery division of a large supermarket had alerted him to the potential for a muffin-based food concept. Financing for the startup was provided from the proceeds of a mortgage his parents took out on their previously debt-free home, plus $400,000 from James Henson, a local businessman who had great faith in Churchill's abilities. The outside investor's $400,000 had come in the form of $100,000 in common equity and $300,000 in 12 percent preferred shares. John Churchill, Henson, and John's father, Henry, each had a third of the voting power in the corporation. John was concerned about his parents' house being at risk.

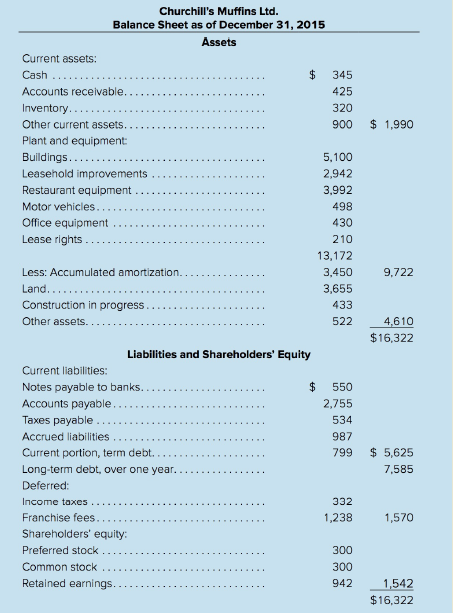

After six years, 79 restaurants were in operation across the country, 30 owned by the company and 49 owned by franchisees. In addition, two company and four franchisee stores were under construction. The balance sheet as of December 31 , 2015, is shown in Exhibit 1.

Each of the shops was built to the same specifications for exterior style and interior decor; each had seating for 30. Many customers ate their purchases in their cars or elsewhere. The buildings were located on approximately one-third of a hectare of land and were designed with parking for 20 to 25 cars. All of the restaurants featured the same menu.

Franchisee agreements generally provided the option of operating a specified number of Churchill's outlets in a defined geographical area. Each new location required an initial payment of $20,000, and an additional royalty of 6 percent of sales was paid to corporate. Franchisees were required to spend at least 1 percent of sales on local advertising. All store managers and company trainees were required to attend a three-week training program in Toronto that covered all aspects of restaurant operations.

Exhibit 1

Churchill's was planning to start construction on another four new company-owned restaurants during 2016. Although the exact size of these had not been determined, John Churchill believed a bigger size with capacity for 50 persons versus the current 30 would be more profitable.

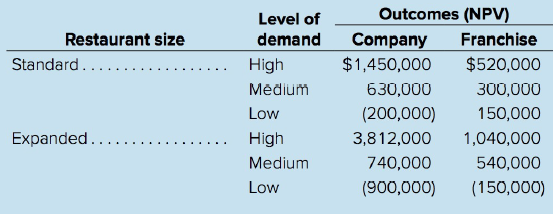

The company faced at least the following two choices-going with their standard units or going to the larger size. The initial cost for the four smaller shops would be $1.6 million in total, but it would be $3 million for the larger shops. Probabilities were estimated at 30 percent for high demand, 40 percent for medium demand, and 30 percent for low demand. Historically, Churchill had used a higher estimated probability of low demand for company stores than for franchisees' stores, based on experience. The present values of the two proposals are given in Table 1

Table 1

Churchill knew this decision facing the company was critical. Although the returns attached to the larger shops seemed more attractive than with the smaller shops, he wondered if the risks were justified.

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta