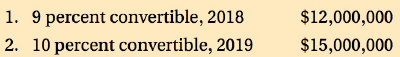

Meyers Business Systems has two million shares of stock outstanding. It also has two convertible bond issues

Question:

The issue with the 9 percent coupon rate was first sold when average A bonds were yielding 12 percent, and it is convertible into 300,000 shares. The issue with the 10 percent coupon rate was first sold when average A bonds were yielding 15.5 percent, and it is convertible into 400,000 shares. Earnings after taxes are $4 million and the tax rate is 50 percent.

The issue with the 9 percent coupon rate was first sold when average A bonds were yielding 12 percent, and it is convertible into 300,000 shares. The issue with the 10 percent coupon rate was first sold when average A bonds were yielding 15.5 percent, and it is convertible into 400,000 shares. Earnings after taxes are $4 million and the tax rate is 50 percent.a. Compute both basic and diluted earnings per share for Meyers.

b. Now assume Meyers also has warrants outstanding, which allow the holder to buy 100,000 shares of stock at $20 per share. The stock is currently selling for $40 per share. Compute basic EPS considering the possible impact of both the warrants and convertibles. The firm's rate of return is 20 percent. Coupon

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: