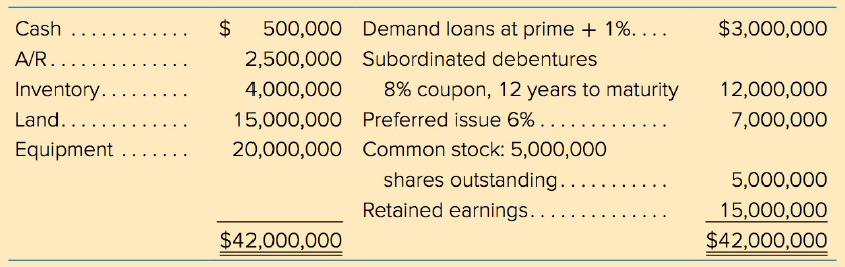

Orbit Corp. has the following balance sheet: Today's market is subject to different supply and demand factors

Question:

Today's market is subject to different supply and demand factors and underlying economic events than when Orbit's capital structure was put in place. This has been translated into the following current yields, which are demanded by the marketplace for a company exhibiting the same risk characteristics as Orbit Corp.:

€¢ The bank's prime rate is now 9.5 percent. The average yield on 91-day T -bills is now 8.5 percent.

€¢ Subordinated debentures would now demand 12 percent; the underwriter would float them for 5 percent of par.

€¢ Preferreds would now call for a stated yield of 11 percent. The underwriters would take 6 percent of issue price for their fee.

€¢ Orbit's stock currently trades on the market at $25. Flotation costs would be 8 percent of the current market price.

This high-growth stock, 12 percent per year, pays no dividends but it has been determined to have a beta of 1. 7. A well-diversified market portfolio of stocks would yield excess returns of 9 percent above the risk-free rate of interest in the foreseeable future.

Retained earnings will be insufficient to contribute the equity portion of funding of new investments. Orbit's tax rate is 23 percent.

a. Calculate Orbit's cost of capital.

b. Would you suggest that Orbit consider paying a small dividend?

c. Explain how Orbit might improve its capital structure. Justify your position.

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Capital Structure

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta