Seasonal Products Corporation expects the following monthly sales: Sales are 20 percent for cash in a given

Question:

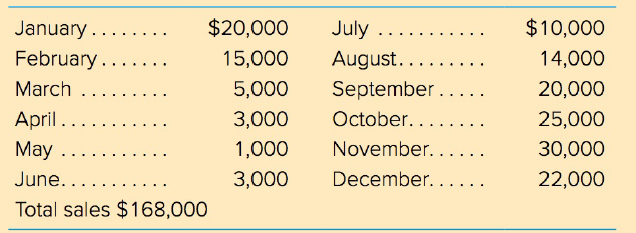

Seasonal Products Corporation expects the following monthly sales:

Sales are 20 percent for cash in a given month, with the remainder going into accounts receivable. All 80 percent of the credit sales are collected in the month following the sale. Seasonal Products sells all of its goods for $2.00 each and produces them for $1.00 each. Seasonal Products uses level production, and average monthly production is equal to annual production divided by 12.

a. Generate a monthly production and inventory schedule in units. Beginning inventory in January is 5,000 units.

b. Determine a cash receipts schedule for January through December. Assume dollar sales in the prior December were $15,000. Work using dollars.

c. Determine a cash payments schedule for January through December. The production costs ($1 per unit produced) are paid for in the month in which they occur. Other cash payments, besides those for production costs, are $6,000 per month.

d. Construct a cash budget for January through December. The beginning cash balance is $1 ,000, and that is also the required minimum.

e. Determine total current assets for each month. (Note: Accounts receivable equal sales minus 20 percent of sales for a given month.)

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta