The CFO of Bogey Golf has been given the following information about two mutually exclusive investments: The

Question:

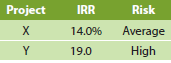

The CFO of Bogey Golf has been given the following information about two mutually exclusive investments:

The CFO normally uses a risk-adjusted required rate of return to evaluate such investments. The firm?s average required rate of return, which is 15 percent, is adjusted by 5 percent for high-risk projects, and it is adjusted by 3 percent for low-risk projects. Which project(s) should Bogey purchase?

Transcribed Image Text:

Project Risk 14.0% 14.0% Average High 19.0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (8 reviews)

Neither project is accep...View the full answer

Answered By

Danish Sohail

My objective is to become most reliable expert for clients. For last 10 years I have been associated with the field of accounting and finance. My aim is to strive for best results and pay particular attention to client needs. I am always enthusiastic to help clients for issues and concerns related to business studies. I can work on analysis of the financial statements, calculate different ratios and analysis of ratios. I can critically evaluate stock prices based on the financial analysis and valuation for companies using financial statements of the business entity being valued with use of excel tools. I have expertise to provide effective and reliable help for projects in corporate finance, equity investments, financial accounting, cost accounting, financial planning, business plans, marketing plans, performance measurement, budgeting, economic research, risk assessment, risk management, derivatives, fixed income investments, taxation, auditing, and financial performance analysis.

4.80+

78+ Reviews

112+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Following is information about two mutually exclusive capital budgeting projects: If the firms required rate of return is 10 percent, which project should be purchased? Cash Flows Project R Year...

-

Dereks Donuts is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. Construct NPV profiles for Projects A and B. b. What is each projects IRR? c....

-

Use the model in File C09 to solve this problem. West Coast Chemical Company (WCCC) is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a....

-

Life Science Incorporated (LSI) is a firm with no debt and its 20 million shares are currently trading for $16 per share. Based on the prospects for one of LSI's new drugs, management feels the true...

-

A balanced three-phase source with VL = 240 V rms is supplying 8 kVA at 0.6 power factor lagging to two wye-connected parallel loads. If one load draws 3 kW at unity power factor, calculate the...

-

The Brain Surgeons Brotherhood faces an own-wage elasticity of demand for their labor that equals -0.1. The Dog Catchers International faces an own-wage elasticity of demand for their labor that...

-

The plaintiffs, Lee and Yoon, were the parents of H.L., a South Korean citizen who attended high school in Idaho as part of an exchange program. With permission from both plaintiffs and his host...

-

The following trial balance of Oakley Co. does not balance. Each of the listed accounts should have a normal balance per the general ledger. An examination of the ledger and journal reveals the...

-

2. (7pts) Give an example of a 44 matrix A which have the following properties: (a) A is lower triangular. All its entries are integers. (b) A has two distinct eigenvalues. Each eigenvalue is a digit...

-

Ellipses Corp is a small business that operates in Herndon, VA. The company is located at10 Period Lane, Herndon, VA 20170. Its federal Employer Identification Number is 77-7777777, and its...

-

Following are three independent projects Peanut/Pecan Processing (PPP) is evaluating: PPP generally considers risk when examining projects by adjusting its average required rate of return, r, which...

-

Global Products plans to issue long-term bonds to raise funds to finance its growth. The company has existing bonds outstanding that are similar to the new bonds it expects to issue. The existing...

-

Find the cross product a b and verify that it is orthogonal to both a and b. a = i j k, b = 1/2i + j + 1/2k

-

A consumer rights organization tests a new car to estimate the cars average gasoline mileage. Because its budget is limited, the organization can test only 25 cars. The standard deviation of the cars...

-

An art dealer at an auction believes that the bid on a certain painting will be a uniformly distributed random variable between $500 and $2,000. (a) What is the probability density function for this...

-

A recent poll shows that 53 % of the voters interviewed strongly support the incumbent and are willing to vote for her in the coming election. The poll was taken by asking 1,000 voters. Estimate the...

-

Suppose the cost of sampling is 50 cents per observation. If the population has zero variance, large a sample should be collected to estimate mean of the population?

-

Suppose the random variable X is best approximated by an exponential distribution with = 8. Find the mean and the variance of X.

-

The drawing shows two boxes resting on frictionless ramps. One box is relatively light and sits on a steep ramp. The other box is heavier and rests on a ramp that is less steep. The boxes are...

-

1. Use these cost, revenue, and probability estimates along with the decision tree to identify the best decision strategy for Trendy's Pies. 2. Suppose that Trendy is concerned about her probability...

-

In terms of the life of the securities offered, what is the difference between money and capital markets?

-

Explain the relationship between inventory turnover and purchasing needs.

-

What is meant by a step-up in the conversion price?

-

When would a preferred stock with a stated maturity most likely see its largest decline in price? Select answer from the options below Never, as a stated maturity date for preferred stock is not...

-

When businesses buy new factories and equipment, this is called A. imports. B. investment spending. C. stock investments. D. depreciation.

-

Cost of Production Report: Weighted Average Method The increases to Work in Process-Roasting Department for Highlands Coffee Company for May as well as information concerning production are as...

Study smarter with the SolutionInn App