A toy manufacturer is considering introducing a line of fishing equipment with an expected life of 5

Question:

A toy manufacturer is considering introducing a line of fishing equipment with an expected life of 5 years. In the past, the firm has been quite conservative in its investment in new products, sticking primarily to standard toys. In this context, the introduction of a line of fishing equipment is considered an abnormally risky project.

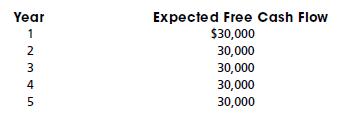

Management thinks that the normal required rate of return for the firm of 10 percent is not sufficient. Instead, the minimum acceptable rate of return on this project should be 15 percent. The initial outlay would be $110,000, and the expected cash flows are as follows:

What is the NPV using the risk-adjusted discount rate? Should the project be accepted?

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty