1. What were the possible risks of Louis Vuittons first-ever television advertising campaign? 2. In fall 2011,...

Question:

2. In fall 2011, the euro/dollar exchange rate was ‚¬1 = $1.35. By spring 2015, the dollar had strengthened to ‚¬1 = $1.10. Assume that a European luxury goods marketer cut the price of an $8,000 linen suit by 10 percent when launching its spring 2015 collection. How would revenues have been affected when dollar prices were converted to euros?

3. Louis Vuitton executives raised prices in the late 2000s, and sales continued to increase. What does this say about the demand curve of the typical Louis Vuitton customer?

4. Compare and contrast LVMH€™s pricing strategy with that of Coach.

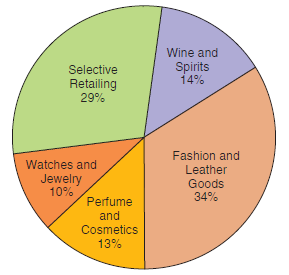

LVMH Moët Hennessy€“Louis Vuitton SA is the world€™s largest marketer of luxury products and brands. Chairman Bernard Arnault has assembled a diverse empire of more than 60 brands, sales of which totaled $40 billion (‚¬29.8 billion) in 2013 (see Figure 11-2). Arnault, whom some refer to as €œthe pope of high fashion,€ recently summed up the luxury business as follows: €œWe are here to sell dreams. When you see a couture show on TV around the world, you dream. When you enter a Dior boutique and buy your lipstick, you buy something affordable, but it has the dream in it.€

Decades ago, the companies that today comprise LVMH were family-run enterprises focused more on prestige than on profit. Fendi, Pucci, and others sold mainly to a niche market comprised of very rich clientele. However, as markets began to globalize, the small luxury players struggled to compete. When Arnault set about acquiring smaller luxury brands, he had three goals in mind. First, he hoped that the portfolio approach would reduce the risk exposure in fashion cycles. According to this logic, if demand for watches or jewelry declined, clothing or accessory sales would offset any losses. Second, he intended to cut costs by eliminating redundancies in sourcing and manufacturing. Third, he hoped that LVMH€™s stable of brands would translate into a stronger bargaining position when managers negotiated leases for retail space or bought advertising.

Sales of luggage and leather fashion goods, including the 162-year-old Louis Vuitton brand, account for 34 percent of revenues (see Figure 11-2). The company€™s Selective Retailing group includes Duty Free Shoppers (DFS) and Sephora. DFS operates €œtravel retail€ stores in international airports around the world; Sephora, which LVMH acquired in 1997, is Europe€™s second largest chain of perfume and cosmetics stores. Driven by such well-known brands as Christian Dior, Givenchy, and Kenzo, perfumes and cosmetics generate nearly 15 percent of LVMH€™s revenues. LVMH€™s wine and spirits unit includes such prestigious Champagne brands as Dom Perignon, Moët & Chandon, and Veuve Clicquot.

Despite the high expenses associated with operating elegant stores and purchasing advertising space in upscale magazines, the premium retail prices that luxury goods command translate into handsome profits. The Louis Vuitton brand alone accounts for about 60 percent of LVMH€™s operating profit. However, unscrupulous operators have taken note of the high margins associated with Vuitton handbags, gun cases, and luggage displaying the distinctive beige-onbrown latticework LV monogram. Louis Vuitton SA spends $10 million annually battling counterfeiters in Turkey, Thailand, China, Morocco, South Korea, and Italy. Some of the money is spent on lobbyists who represent the company€™s interests in meetings with foreign government officials. Yves Carcelle, chairman of Louis Vuitton SA, recently explained, €œAlmost every month, we get a government somewhere in the world to destroy canvas, or finished products.€

Another problem is a flourishing gray market. Givenchy and Christian Dior€™s Dune fragrance are just two of the luxury perfume brands that are sometimes diverted from authorized channels for sale at mass-market retail outlets. However, LVMH and other luxury goods marketers found a new way to combat gray market imports into the United States. In March 1995, the U.S. Supreme Court let stand an appeals court ruling prohibiting a discount drugstore chain from selling Givenchy perfume without permission. Parfums Givenchy USA had claimed that its distinctive packaging should be protected under U.S. copyright law. The ruling has meant that Costco, Walmart, and other discounters cannot sell some imported fragrances without authorization.

Figure 11-2

Exhibit 11-8

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: