A Bill Smithson runs a second-hand furniture business from a shop which he rents. He does not

Question:

A Bill Smithson runs a second-hand furniture business from a shop which he rents. He does not keep complete accounting records, but is able to provide you with the following information about his financial position at 1 April 2018: Inventory of furniture \(£ 3,210\); Trade receivables \(£ 2,643\); Trade payables \(£ 1,598\); Motor vehicle \(£ 5,100\); Shop fittings \(£ 4,200\); Motor vehicle expenses owing \(£ 432\).

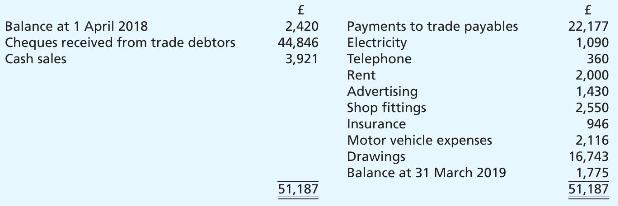

He has also provided the following summary of his bank account for the year ended 31 March 2019:

All cash and cheques received were paid into the bank account immediately.

You find that the following must also be taken into account:

Depreciation is to be charged on the motor vehicle at \(20 \%\) and off the shop fittings at \(10 \%\), calculated on the book values at 1 April 2018 plus additions during the year.

- At 31 March 2019 motor vehicle expenses owing were \(£ 291\) and insurance paid in advance was \(£ 177\).

- Included in the amount paid for shop fittings were:

a table bought for \(£ 300\), which Smithson resold during the year at cost, some wooden shelving (cost \(£ 250\) ), which Smithson used in building an extension to his house.

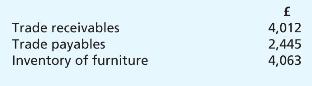

Other balances at 31 March 2019 were:

\section*{Required:}

(a) For the year ended 31 March 2019:

(i) calculate Smithson's sales and purchases, (ii) prepare his income statement.

(b) Prepare Smithson's balance sheet as at 31 March 2019.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood