A company maintains its non-current assets at cost. A separate accumulated depreciation account is used for each

Question:

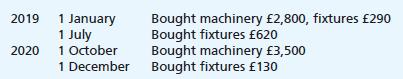

A company maintains its non-current assets at cost. A separate accumulated depreciation account is used for each type of asset. Machinery is to be depreciated at the rate of 15% per annum, and fixtures depreciated at the rate of 5% per annum, using the reducing balance method. Depreciation is to be calculated on assets in existence at the end of each year, giving a full year’s depreciation even though the asset was bought part of the way through the year. The following transactions in assets have taken place:

The financial year end of the business is 31 December.

You are to show:

(a) The machinery at cost account.

(b) The fixtures at cost account.

(c) The two separate accumulated depreciation accounts.

(d) The non-current assets section of the balance sheet at the end of each year, for the years ended 31 December 2019 and 2020.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood