Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3

Question:

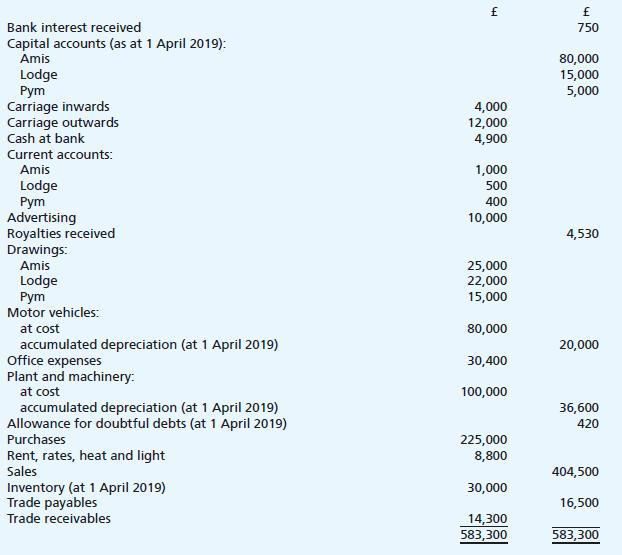

Amis, Lodge and Pym were in partnership sharing profits and losses in the ratio 5 : 3 : 2. The following trial balance has been extracted from their books of account as at 31 March 2020:

Additional information:

(a) Inventory at 31 March 2020 was valued at £35,000.

(b) Depreciation on the non-current assets is to be charged as follows:

Motor vehicles – 25% on the reduced balance.

Plant and machinery – 20% on the original cost.

There were no purchases or sales of non-current assets during the year to 31 March 2020.

(c) The allowance for doubtful debts is to be maintained at a level equivalent to 5% of the total trade receivables as at 31 March 2020.

(d) An office expense of £405 was owing at 31 March 2020, and some rent amounting to £1,500 had been paid in advance as at that date. These items had not been included in the list of balances shown in the trial balance.

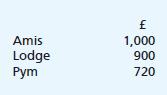

(e) Interest on drawings and on the debit balance on each partner’s current account is to be charged as follows:

(f) According to the partnership agreement, Pym is allowed a salary of £13,000 per annum. This amount was owing to Pym for the year to 31 March 2020 and needs to be accounted for.

(g) The partnership agreement also allows each partner interest on his capital account at a rate of 10% per annum. There were no movements on the respective partners’ capital accounts during the year to 31 March 2020, and the interest had not been credited to them as at that date.

(h) On 1 April 2020, Fowles Limited agreed to purchase the business on the following terms:

(i) Amis to purchase one of the partnership’s motor vehicles at an agreed value of £5,000, the remaining vehicles being taken over by the company at an agreed value of £30,000;

(ii) the company agreed to purchase the plant and machinery at a value of £35,000 and the inventory at a value of £38,500;

(iii) the partners to settle the trade payables: the total amount agreed with the creditors being £16,000;

(iv) the trade receivables were not to be taken over by the company, the partners receiving cheques on 1 April 2020 amounting to £12,985 in total from the trade debtors in settlement of the outstanding debts;

(v) the partners paid the outstanding office expense on 1 April 2020, and the landlord returned the rent paid in advance by cheque on the same day;

(vi) as consideration for the sale of the partnership, the partners were to be paid £63,500 in cash by Fowles Limited, and to receive £75,000 in £1 ordinary shares in the company, the shares to be apportioned equally amongst the partners.

(i) Assume that all the matters relating to the dissolution of the partnership and its sales to the company took place on 1 April 2020.

Required:

(a) Prepare:

(i) Amis, Lodge and Pym’s income statement and profit and loss appropriation account for the year ending 31 March 2020;

(ii) Amis, Lodge and Pym’s current accounts (in columnar format) for the year to 31 March 2020 (the final balance on each account is to be then transferred to each partner’s respective capital account);

and

(b) Compile the following accounts:

(i) the partnership realisation account for the period up to and including 1 April 2020;

(ii) the partners’ bank account for the period up to and including 1 April 2020; and (iii) the partners’ capital accounts (in columnar format) for the period up to and including 1 April 2020.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood