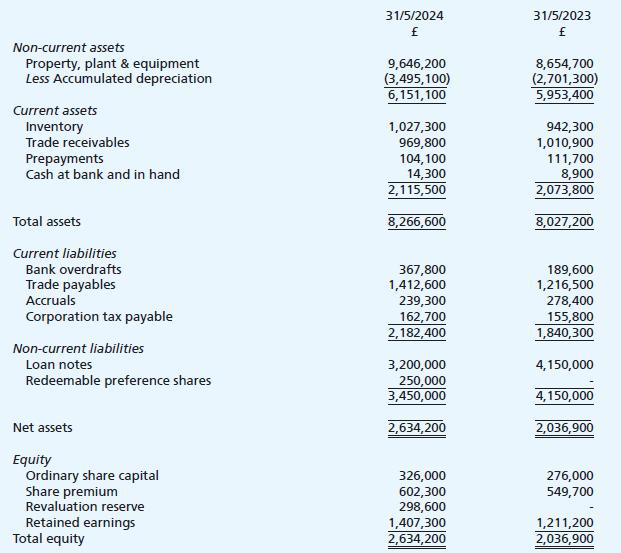

As at 31 May 2024 and 31 May 2023, Dendry Ltd had the following balance sheets: The

Question:

As at 31 May 2024 and 31 May 2023, Dendry Ltd had the following balance sheets:

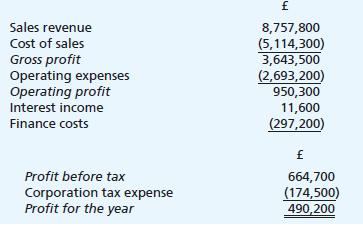

The company’s income statement for the year ended 31 May 2024 was as follows:

Note also the following additional information:

(i) The operating profit shown above is stated after charging depreciation of £836,200.

(ii) During the year ended 31 May 2024, Dendry Ltd acquired new plant and equipment for £780,000 cash. The company also disposed of plant and equipment for £39,500 cash.

(iii) In April 2024, the freehold land owned by the company was valued at £500,000, and this new value has been incorporated in the above financial statements.

(iv) There were no amounts outstanding in respect of interest receivable as at either year end date.

(v) Included within the figure for accruals at 31 May 2024 is £59,400 for interest payable. The corresponding figure for 2023 was £47,300.

(vi) In October 2023, the company issued 250,000 £1 redeemable preference shares at par.

(vii) In August 2023, Dendry Ltd made a 1-for-10 bonus issue of ordinary shares using the share premium account. In February 2024, the company made a successful rights issue of ordinary shares at a price above par value.

Required:

Using the indirect method, prepare the statement of cash flows for Dendry Ltd for the year ended 31 May 2024, in accordance with IAS 7 Statement of Cash Flows.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood