Baba is the owner of a delivery business. The following balances were in her books on 1

Question:

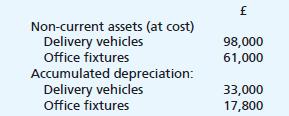

Baba is the owner of a delivery business. The following balances were in her books on 1 March 2023:

Baba’s depreciation policy is:

• Delivery vehicles at the rate of 20% per annum reducing balance • Office fixtures at the rate of 15% per annum straight line • A full year’s depreciation is charged in the year of purchase • No depreciation is charged in the year of sale • All disposals are recorded in a single non-current asset disposal account.

Additional information for the year ended 29 February 2024:

(1) Delivery vehicles with a cost of £18,000, and accumulated depreciation of £9,000, were sold by cheque for £8,400 during the year.

(2) Delivery vehicles costing £24,000 were purchased during the year, paying by cheque.

(3) Office fixtures costing £12,000, and with an accumulated depreciation of £5,400, were sold for £400 cash.

(4) Additional office fixtures were purchased at a cost of £21,000, paying by cheque.

Required:

(a) Explain why Baba needs to charge depreciation on non-current assets for the year.

(b) Calculate, for the year ended 29 February 2024, the depreciation of the:

(i) Delivery vehicles (ii) Office fixtures.

(c) Prepare, for the year ended 29 February 2024, the:

(i) Delivery Vehicles Account (ii) Delivery Vehicles - Accumulated Depreciation Account (iii) Disposal Account for all non-current assets.

Baba records computers in her office fixtures account. She is concerned that each year she scraps computers that still have a significant book value.

(d) Evaluate Baba’s current policy of including computers as office fixtures.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood