Lohit is in business buying and selling goods on credit. The following information relates to his bad

Question:

Lohit is in business buying and selling goods on credit. The following information relates to his bad and doubtful debts for the year ended 31 August 2024.

1 Balance of Allowance for Doubtful Debts Accounts on 1 September 2023 was £1,100 2 Bad debts

3 Bad debts recovered The balance of £400 owed by Arca had been written off on 20 July 2022. A cheque for part payment of the debt was received for £250 on 15 June 2024.

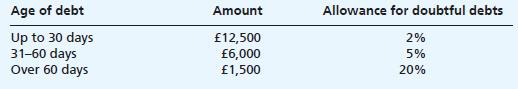

4 Schedule of trade receivables 31 August 2024

Required:

(a) Prepare the following at 31 August 2024, including year-end transfers where appropriate.

(i) Journal entries, including narratives and bank entries:

• bad debt of Smith and Sons • recovery of part of the debt written off from Arca.

(ii) Bad Debts Account (iii) Bad Debts Recovered Account (iv) Allowance for Doubtful Debts Account.

(b) Explain four elements of good credit control.

A friend of Lohit stated, ‘I do not know why you use an allowance for doubtful debts account. It is better to write off the bad debts when they actually occur.’

(c) Evaluate the friend‘s statement.

(Edexcel A level)

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood