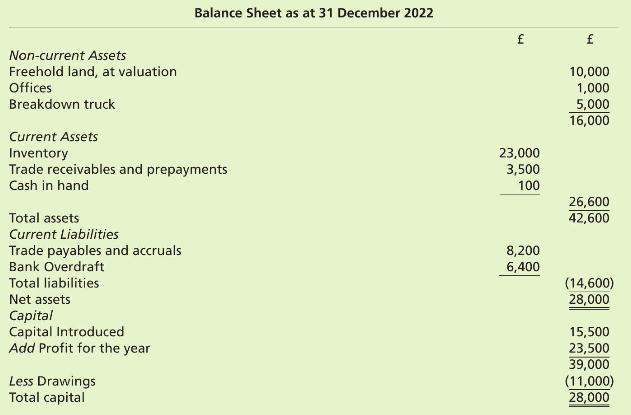

The following balance sheet has been prepared by your client, Mr Conman, proprietor of the Sleasy Cars

Question:

The following balance sheet has been prepared by your client, Mr Conman, proprietor of the Sleasy Cars second-hand car dealership:.

This was the first year of trading for Sleasy Cars. Mr Conman acquired a field in Hull (which had previously been used for a rubbish tip and then filled in) for \(£ 5,000\) on 1 January 2022 and erected a portacabin on the site to be used as an office at a cost of \(£ 500\). He then bought ten second hand cars from a national dealership for \(£ 10,000\). He has some accountancy training and has taken a lot of care in producing the balance sheet but confesses that he did not produce an income statement. Instead, as it must be the correct figure, the amount shown for profit in the balance sheet was the amount required to make it balance.

The following points have come to light in your discussion:

(i) The office was bought at a discount from a friend who had acquired it from a builder's yard and Conman has included it in the balance sheet at the proper price as he knows that accountants like original costs to be shown. The office should last for five years and Conman agrees that maybe that thing called depreciation should be included at straight line. The office will be worthless at the end of the five years.

(ii) The land was a bargain. Conman heard on the grapevine that the council were going to take the previous owners to court as it was an environmental hazard. The owners put it up for sale at \(£ 10,000\) so he made an offer to the owners of \(£ 5,000\) which was accepted. He is ignoring the court order to clean up the site since this would cost approximately \(£ 3,000\). His reason for ignoring it is that although the order was made in December 2021 (i.e. before he bought the land), he did not receive the notice until January 2023 (i.e. after he had bought the land).

(iii) The breakdown truck is very old and was bought at the start of the year. It has been shown at cost although it is probably only going to last another year and will have no residual value.

(iv) Inventory has all been valued at cost although on one car there is a good chance that it will sell at a loss of \(£ 500\). Another one was sold in January 2023 for \(£ 3,000\) but the new owner has not picked it up yet - the profit was \(£ 1,500\) so this has been included in the valuation of the car. As he has included the car, Conman has not included the debtor in the balance sheet.

(v) A customer has owed \(£ 2,000\) for six months and Mr Conman is becoming slightly bothered. The customer has moved away from the address she gave Mr Conman and he thinks that this debt might not be recoverable.

(vi) After hearing the above, you have decided to check the figures and have found that the cash, overdraft and drawings figures are correct and also that there has been no adjustment for the fact that he has not paid his electricity bill of \(£ 250\) nor his telephone bill of \(£ 150\). The reason for this is that he is subletting part of the field and is owed \(£ 400\) in rent and, therefore, the two cancel each other out.

\section*{Required}

(a) A revised balance sheet after taking into account all of the above.

(b) A description of each of the adjustments that have been made and why each of them is necessary.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood