The following balances were extracted from the books of Mr Try, a window cleaner. He has no

Question:

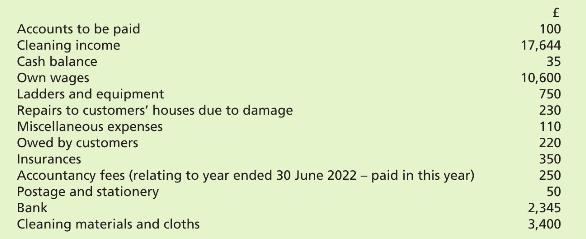

The following balances were extracted from the books of Mr Try, a window cleaner. He has no knowledge of double entry bookkeeping but records everything correctly. His year end is 30 June and the following balances relate to the year ended 30 June 2023:

He has not included the following items as he is not sure how to record them:

(i) Bank charges of \(£ 45\) are to be levied for the year - they are to be processed by the bank in September 2023.

(ii) Insurances have been prepaid by \(£ 50\).

(iii) None of the amounts owed by customers can be realistically recovered but Mr Try wants to keep on trying and therefore wants an allowance to be made of 50 per cent of the balances.

(iv) Accountancy charges for the current year ended 2023 are to be \(£ 275\).

(v) The ladders, including the ones bought in the year, will only last until the end of 2024 and are to be depreciated using the straight line method with no residual value.

Required

(a) Prepare an income statement for the year ending 30 June 2023.

(b) Prepare a balance sheet at that date.

(c) Mr Try has heard about a treatment of non-current assets which he thinks is 'consumables'. He wonders if his ladders could be treated as consumables and not depreciated. Write a letter to Mr Try, using fictitious names and addresses, to answer his query.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood