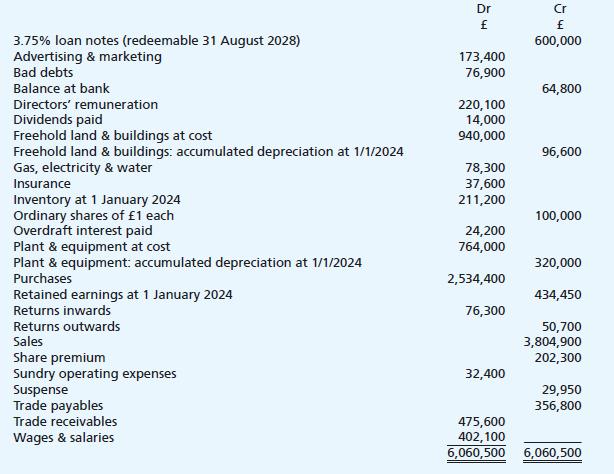

The following trial balance has been extracted from the nominal ledger of Archara Ltd as at 31

Question:

The following trial balance has been extracted from the nominal ledger of Archara Ltd as at 31 December 2024:

The following matters also need to be considered before preparing the financial statements:

(i) It has subsequently been discovered that a credit note received from a supplier for £2,970 has been posted to the correct accounts but as £9,720.

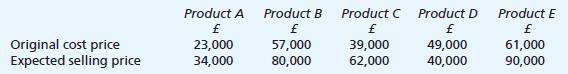

(ii) Inventory at 31 December 2024 was counted and valued at a cost of £229,000. The company’s inventory comprises just five products, as follows:

(iii) The company paid an insurance premium of £22,800 on 15 June 2024 in respect of insurance for the 12-month period ending 31 July 2025.

(iv) Bharami Ltd is one of the company’s customers and it owed £22,000 to Archara Ltd as at 31 December 2024. However, Bharami Ltd ceased trading on 14 January 2025 as a result of severe financial difficulties. The liquidators of Bharami Ltd do not expect to pay any money to creditors.

(v) The company’s depreciation policy is as follows:

• buildings - straight line over 50 years • plant & equipment - 25% reducing balance.

The company’s non-current assets include freehold land which originally cost £250,000.

(vi) Archara Ltd employed the services of a new marketing agency for a six-month period commencing 1 December 2024. The total fee for the six months was agreed at £108,000. 50% of this fee is to be paid on 28 February 2025 with the rest payable on 31 May 2025. No entries whatsoever have yet been made in the books of Archara Ltd in relation to this deal.

(vii) A cheque for £29,950 was received by the company on 27 December. The cheque was banked by the cashier but the source of the cheque was unknown, so she posted it to suspense. It has now been discovered that it was in respect of a bad debt that had been written off in 2022.

(viii) The 3.75% loan notes were first issued on 1 September 2024. The interest is payable in two annual instalments on 28 February and 31 August each year.

(ix) The directors are planning to propose a final dividend of 22p per share for 2024.

(x) The corporation tax charge on the profit for the year is estimated to be £17,600 (this estimate is unaffected by the various matters above).

Required:

Adopting a presentation appropriate for publication, prepare an income statement for Archara Ltd for the year ended 31 December 2024 along with a balance sheet as at the same date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood