You are required to answer the following four questions: (a) The balance of retained earnings in the

Question:

You are required to answer the following four questions:

(a) The balance of retained earnings in the balance sheets of Mankara Ltd as at 31 December 2023 and 31 December 2024 was £278,000 and £319,000, respectively. Total ordinary dividends paid during 2024 amounted to £33,000. What was the company’s profit for the year ended 31 December 2024?

(b) Wawrinka Ltd has a balance on its ordinary share capital account of £100,000, consisting of fully-paid ordinary shares with a par value of 10 pence each. The company also has 100,000 5%

irredeemable preference shares with a par value of 50 pence each in issue. No dividends whatsoever have yet been paid in relation to the year ended 31 December 2024 but the directors wish to pay a dividend of 5 pence per ordinary share. What total dividend payment would be required to achieve this?

(c) On 1 January 2024, Badara plc had an issued ordinary share capital of £160,000 (comprising 50p ordinary shares) and a balance on its share premium account of £690,000. On 16 January 2024, the company made a 1-for-4 bonus issue of ordinary shares, making use of the share premium account. What double entry records this bonus issue?

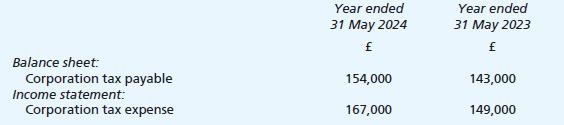

(d) You are given the following information extracted from the financial statements of Iwobi plc:

What was the total corporation tax paid by this company during its year ended 31 May 2024?

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood