Arnold Traders, a sole proprietor, did not keep proper accounting records. Mr Arnold furnished you with this

Question:

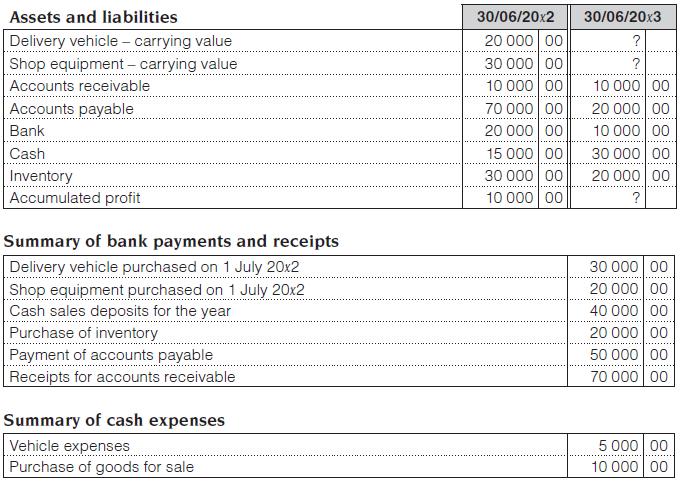

Arnold Traders, a sole proprietor, did not keep proper accounting records. Mr Arnold furnished you with this information relating to Arnold Traders that he extracted from his note book:

Additional information:

1. Mr Arnold paid most major items of expenditure by cheque. Certain other items were paid out of cash takings and the balance of the cash receipts was banked every week.

2. Depreciation must be provided for at 20% per annum on the reducing balance method for the delivery vehicle and shop equipment.

3. On 1 July 20x0, the delivery vehicle and shop equipment (shown on 30 June 20x2) were bought.

You are required to:

1. Prepare the statement of profit or loss & other comprehensive income of Arnold Traders for the year ended 30 June 20x3.

2. Prepare the statement of financial position as at 30 June 20x3.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit