At a meeting of the board of directors of Nahim Ltd it was decided: On 30

Question:

At a meeting of the board of directors of Nahim Ltd it was decided:

• On 30 September 20x1, to redeem the redeemable preference shares of the company.

• To achieve this by a fresh issue of the maximum number of ordinary shares permissible without the necessity to call a meeting of shareholders. The issue price for the proposed issue would be R1.20/share.

• After the redemption and the issue have been made that a proposal is put to the shareholders at a general meeting to increase the authorised share capital by an amount sufficient to allow a capitalisation issue of one ordinary share for every two ordinary shares already held at the current market price of R1.20/share.

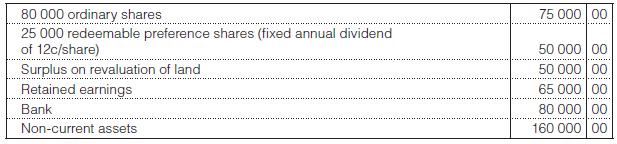

This information is from the records of Nahim Ltd as at 31 August 20x1:

Additional information:

1. The redeemable preference shares are redeemable at a premium of 20c/share at any time, at the option of the company. Dividends for the current year must be paid to the date of redemption.

2. The authorised share capital of the company is:

– 100 000 ordinary shares.

– 25 000 redeemable preference shares.

3. The directors have the power to issue unissued shares.

4. The company has sufficient cash, together with the proceeds of the fresh issue, to make any payments that can be required.

5. The company earned a profit after taxation of R5 000 for the month of September 20x1.

6. Expenses related to the share issue amount to R1 000.

7. The year end for the company is 31 March.

You are required to:

1. Record the general journal entries for the redemption and the fresh issue of shares on 30 September 20x1.

2. Prepare the equity and liabilities section of the statement of financial position, as it would appear immediately after the redemption and fresh share issue. Presentation must comply with the requirements of the Companies Act and IAS 1. Show all workings separately.

3. Show, by means of an abridged journal entry, the effect of the directors’ decision on the issue of capitalisation shares, should it be confirmed by the shareholders.

4. Give one good reason for the elaborate provisions made by the Companies Act regulating the procedure for the redemption of redeemable preference shares.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit