At the beginning of 2011, Precision Manufacturing purchased a new computerized drill press for ($ 50,000). It

Question:

At the beginning of 2011, Precision Manufacturing purchased a new computerized drill press for \(\$ 50,000\). It is expected to have a five-year life and a \(\$ 5,000\) salvage value.

Required

a. Compute the depreciation for each of the five years, assuming that the company uses

(1) Straight-line depreciation.

(2) Double-declining-balance depreciation.

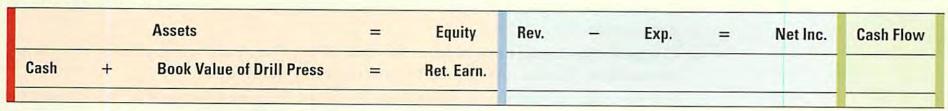

b. Record the purchase of the drill press and the depreciation expense for the first year under the straight-line and double-declining-balance methods in a financial statements model like the following one:

c. Prepare the journal e ntries to recognize depreciation for each of the five years, assuming that the company uses

(1) Straight-line depreciation.

(2) Double-declining-balance depreciation.

Step by Step Answer: