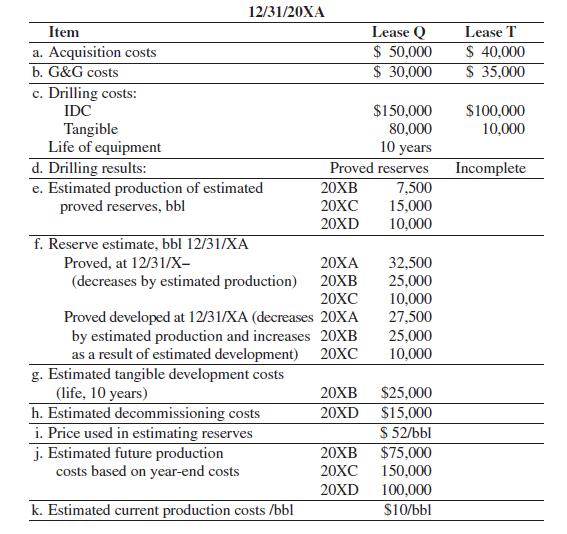

Buckley Oil Company, a successful efforts company, began operations January 1, 20XA. Assume the following facts about

Question:

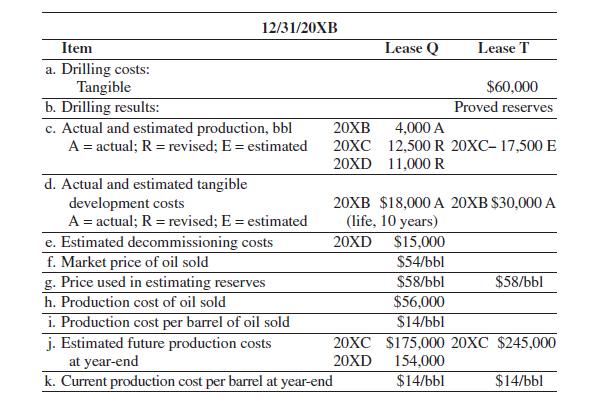

Buckley Oil Company, a successful efforts company, began operations January 1, 20XA. Assume the following facts about Buckley’s first two years of operations:

Assume a tax rate of 40%, and that Buckley does not qualify for percentage depletion because it is an integrated producer. Ignore deferred taxes and the alternative minimum tax. (What is the significance of no estimated future development costs on Lease Q and Lease T as of 12/31/XB?)

REQUIRED:

Prepare the required disclosures under ASU 932-235-50. All reserve and production quantities apply only to Buckley Oil’s interest. Ignore the computations for future income tax.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: