Charles, Diana and William are partners in a family business, CDW Partners. Their abridged statement of financial

Question:

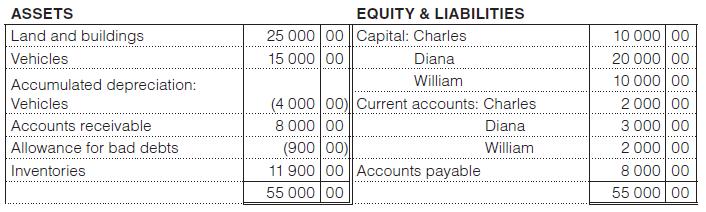

Charles, Diana and William are partners in a family business, CDW Partners. Their abridged statement of financial position as at 30 June 20x3 was: (Ignore VAT.)

Their partnership agreement states that Charles, Diana and William will share profits and losses in the ratio 2 : 2 : 1, and that goodwill will not be reflected as an asset.

On 30 June 20x3, Diana decided to withdraw from the partnership to start her own manufacturing business, and it was agreed that:

1. Theses assets would be revalued:

![]()

2. The partners cancelled a life policy with a surrender value of R5 000. The proceeds were paid to Diana.

As the partnership did not have sufficient cash to pay Diana for her remaining share of the partnership, it was agreed that a loan account be created and she would be repaid in monthly instalments over the next 14 months, starting on 1 July 20x3.

4. It was agreed that the amount owing to Diana would be R29 960.

5. Charles and William agreed to share profits and losses equally in their new partnership.

On 2 July 20x3, Charles and William decided to dissolve the partnership. All assets with the exception of accounts receivable were sold for R70 000.

You are required to:

1. Do the journal entries to record Diana’s withdrawal from the partnership.

2. Do a calculation to show how cash should be distributed so that neither Charles nor William would be called upon to refund any cash received.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit