Gamble Company, a successful efforts company, owns a working interest in an oil field in Alaska. The

Question:

Gamble Company, a successful efforts company, owns a working interest in an oil field in Alaska. The field has been producing for a number of years and is expected to be producing for another 10 years. On January 1, 2019, the net book value of the field wells, equipment, and facilities totals $5,000,000. Gamble determines that it should book an ARO in relation to the field. The undiscounted future cash flows to settle the ARO are estimated to be $2,000,000. When discounted at a rate of 8% for 10 years, the present value is $926,390.

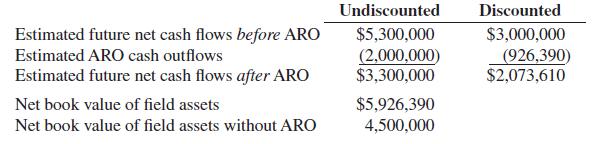

Later that year, Gamble’s chief accountant determines that, due to changes in the state tax laws, the field should be assessed for impairment. Analysis yields the following information:

REQUIRED:

a. Make the entry to record the ARO on January 1, 2019.

b. Determine the net book value of the field after the ARO is recorded.

c. Explain how impairment would be computed if circumstances indicate the asset may be impaired.

Step by Step Answer: