Garvin Oil Company incurred the following costs during the years 2018 and 2019: 2018 a. Contracted and

Question:

Garvin Oil Company incurred the following costs during the years 2018 and 2019:

2018

a. Contracted and paid $50,000 for G&G surveys during the year.

b. Leased acreage in four areas as follows:

1) Marrow lease—500 acres @ $50/acre bonus; other acquisition costs, $2,000 2) Richards lease—800 acres @ $100/acre bonus; other acquisition costs, $3,000 3) Onyx lease—200 acres @ $60/acre bonus; other acquisition costs, $500 4) Raupe lease—600 acres @ $30/acre bonus; other acquisition costs, $800 Each lease had a delay rental clause requiring payment of $10 per acre if drilling was not commenced by the end of one year. Also, each of the above leases was considered individually significant.

c. The company also leased 10 individual tracts for a total consideration of $60,000. The tracts are considered to be individually insignificant and are the first individually insignificant unproved properties acquired by Garvin.

d. The company incurred $1,000 in costs to maintain lease and land records in 2018.

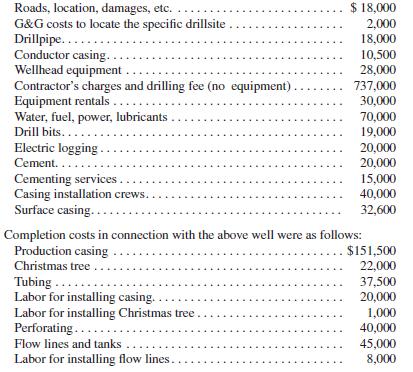

e. During 2018, the company incurred the following costs in connection with the Maxwell lease when drilling an exploratory well:

f. An exploratory well was drilled on the Richards lease in 2018 on a turnkey basis to 9,000 feet. The contractor’s charge was $300,000, which included $40,000 for casing. At the end of 2018, a decision had not been made to complete or abandon the well. Both criteria for maintaining the suspended well classification were met.

g. At the end of 2018, the Raupe lease was impaired by 40%, and the Onyx lease by 20%. The company has a policy of maintaining an allowance for impairment equal to 60% of individually insignificant leases.

2019

a. Delay rentals were paid on the Onyx and Raupe leases.

b. Late in 2019, the company abandoned the Onyx lease and two of the individually insignificant leases, which cost a total of $8,000 when acquired.

The Raupe lease is now considered to be a very valuable lease, because a large producer was found on adjacent property.

c. At year-end, the company still could not decide whether to complete or abandon the well on the Richards lease, and both criteria for delaying classification of the well were no longer met.

REQUIRED: Prepare journal entries for the above transactions.

Step by Step Answer: