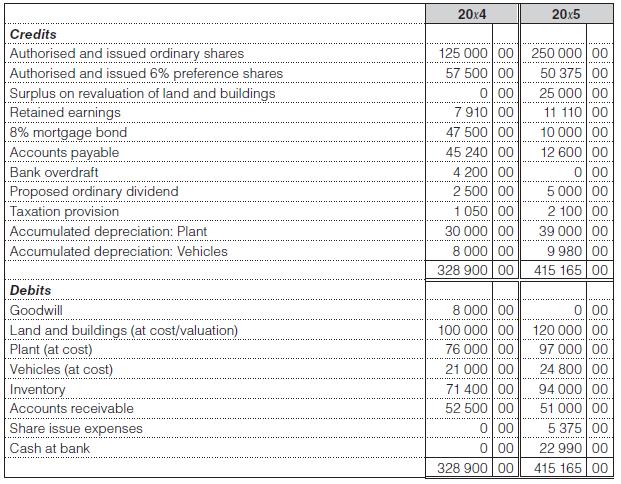

Here are the post-closing trial balances of Pine Oak Ltd as at 30 June 20x4 and 30

Question:

Here are the post-closing trial balances of Pine Oak Ltd as at 30 June 20x4 and 30 June 20x5:

Additional information:

1. In March 20x5, the company sold a vacant stand that cost R5 000 for R10 000 cash and had the remaining property revalued by a sworn appraiser. The directors decided to show the property in the books at the increased value.

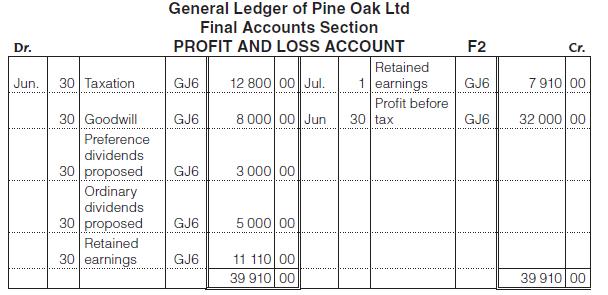

2. Included in the profit before tax is interest paid of R3 000, and interest received of R1 800.

3. Revenue for the year amounted to R168 000.

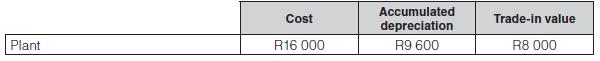

4. During July 20x4, the company purchased additional plant and traded in this asset in part settlement of the purchase price of the plant.

The company does not depreciate non-current assets sold during the year.

5. Profit and loss account for the year ended 30 June 20x5:

6 During January 20x5, the company issued the balance of its shares.

– Issue expenses of R5 375 were incurred.

– In terms of a directors’ resolution, the issue expenses must be written off.

You are required to:

Prepare the statement of cash flows and notes for the year ended 30 June 20x5.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit