Here is a list of balances and totals as at 30 June 20x9, from the books of

Question:

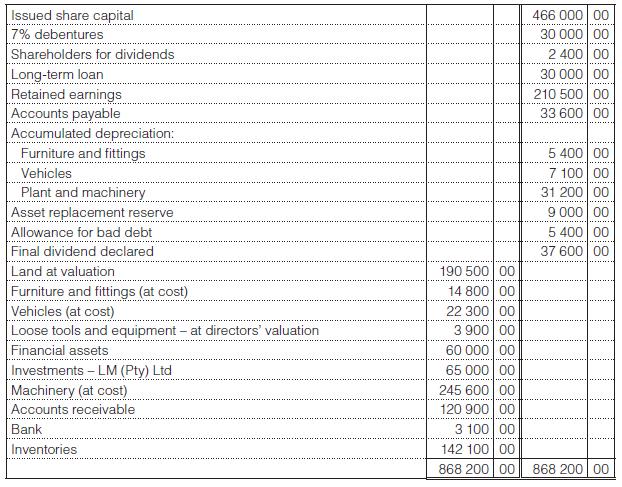

Here is a list of balances and totals as at 30 June 20x9, from the books of Lapping Ltd.

The registered office of the company is at 12 Robberts Road, Bellville. The detailed trading and profit and loss accounts for the year ended have already been completed.

This additional information is available:

• Share capital

– Authorised:

* 650 000 ordinary shares.

* 50 000 redeemable preference shares (fixed annual dividend of 9c/share).

– Issued:

* 400 000 ordinary shares.

* All the redeemable preference shares have been issued @ R1 each.

• Included in accounts payable is an amount of R3 600, due to the SARS for income tax payable for this year. This amount could not be estimated with reasonable certainty.

• A director holds an option to acquire 60 000 ordinary shares. The redeemable preference shares are redeemable at R1 each as from 1 January 20x9, at the option of the company.

• The debentures and the loan are secured by a first and second mortgage bond respectively over land.

• Accounts receivable include loans of R12 000 allocated to certain directors during the year. An amount of R3 000 had been paid by one of the directors during the year towards the reduction of his loan.

• The bank balance of R3 100 includes an overdraft of R6 500 with a different bank.

• Replacement of loose tools and small items of equipment is charged directly to maintenance, the total of that is written off against income each year.

• On 14 September 20x9, the company ordered new machinery at an estimated cost of R50 000. No payments had been made on account of this machinery by the end of the financial year and it will be paid from cash derived from normal business operations.

• Land consists of six different plots and were revalued in February 20x8.

• The investment in LM (Pty) Ltd consists of 65 000 ordinary shares and the directors valued these shares at R2 each.

– Upon buying all the shares of LM (Pty) Ltd, the company guaranteed the bank overdraft of LM (Pty) Ltd.

– This overdraft had not yet been repaid at 30 June 20x9.

You are required to:

Prepare the statement of financial position of Lapping Ltd at 30 June 20x9 to comply with the requirements of the Companies Act 71 of 2008 and with IFRS. (Comparatives are not required.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit