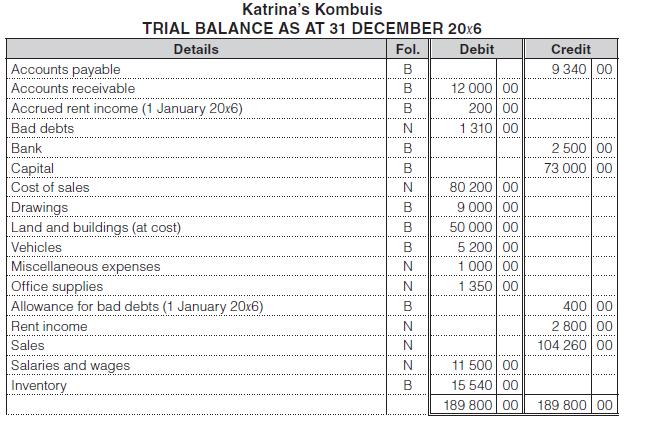

Here is the trial balance of Katrinas Kombuis as at 31 December 20x6. It is Katrinas policy

Question:

Here is the trial balance of Katrina’s Kombuis as at 31 December 20x6. It is Katrina’s policy to determine selling prices by marking up all goods by 30% on cost, and to use the perpetual inventory system.

Additional information:

1. Goods ordered from a supplier on 10 December 20x6 were despatched on 20 December.

– The goods were awaiting collection at the Spoornet despatch warehouse on 28 December.

– The goods, with an invoice cost of R800, had not been recorded as a purchase by 31 December and were not collected by the business until 4 January 20x7.

2. On 31 December 20x6, a dissatisfied receivable had returned goods with a selling price of R260.

– Katrina decided to take the returned items for her own use and informed her bookkeeper.

– The bookkeeper had just journalised and posted an entry debiting drawings and crediting accounts receivable with R260.

3. During October 20x6, goods that cost R300 had been stolen from one of the business’s delivery vehicles.

– The insurance company agreed to send a cheque for R250 in January 20x7, in full settlement of the claim.

– The above entries had not been recorded as at 31 December 20x6.

4. A physical inventory count made after the close of business on 31 December 20x6 revealed inventory on hand at cost of R15 240. On the same date, unused office supplies were valued at R450.

5. A portion of the business’s premises is leased to an accounting business for R200 per month. The rent of January 20x7 was received and banked on 30 December 20x6.

6. It is the business’s policy to make an allowance for uncollectable receivables accounts at the end of each financial year. Experience has shown that an estimated 2% of the year-end accounts receivable balances will prove to be uncollectable.

7. On 30 September 20x6, a vehicle that was valued in the books at R4 000, was sold for R1 600 cash. The only entry recorded for this transaction was to debit the bank account and to credit the vehicles account with R1 600.

You are required to:

1. Record any corrections or adjustments that may be necessary on a worksheet.

2. Use the adjusted trial balance to prepare the statement of profit or loss & other comprehensive income for the 20x6 financial year.

3. Prepare a statement of financial position as at 31 December 20x6.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit