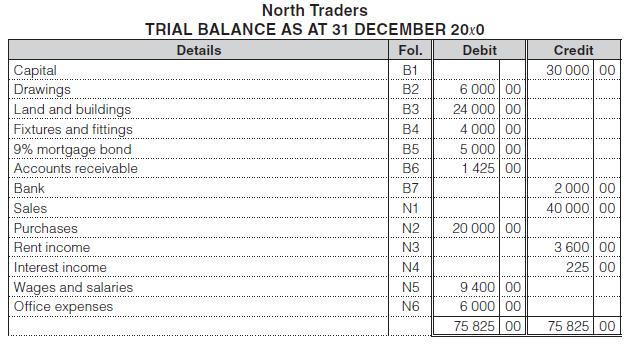

Here is the trial balance of North Traders as at 31 December 20x0 (financial year end): Additional

Question:

Here is the trial balance of North Traders as at 31 December 20x0 (financial year end):

Additional information:

• The business lets a portion of its premises at a monthly rent of R300. The property was first let on 1 April 20x0 and the lessee pays the rent quarterly, in advance.

• On 1 January 20x0 the business lent R5 000 to one of its main suppliers for a three-year period. Interest on the loan is payable half-yearly, in arrears, on 1 July and 1 January until the loan is repaid.

• Wages amounting to R600 were earned by the business’s employees in December 20x0 but were only paid on 3 January 20x1.

• The inventory of unused office stationery on hand at 31 December 20x0 was R500. The cost of all stationery purchased is included in office expenses.

• Fixtures and fittings were purchased on 1 January 20x0, and are to be depreciated at 10% per annum calculated on original cost.

• The cost of unsold goods on hand at 31 December 20x0, as determined by an inventory count, was R3 250.

• R2 000 new capital was invested in the business on 1 July 20x4.

You are required to:

1 Record the adjusting journal entries.

2 Prepare the statement of profit or loss & other comprehensive income and the statement of financial position as at 31 December 20x0.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit