In 2018, Aggie Oil Corporation began operations exclusively in the United States. Give the entries, assuming the

Question:

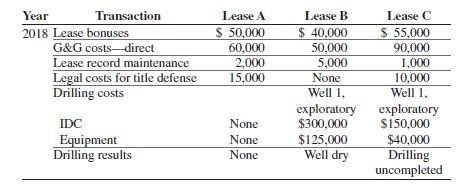

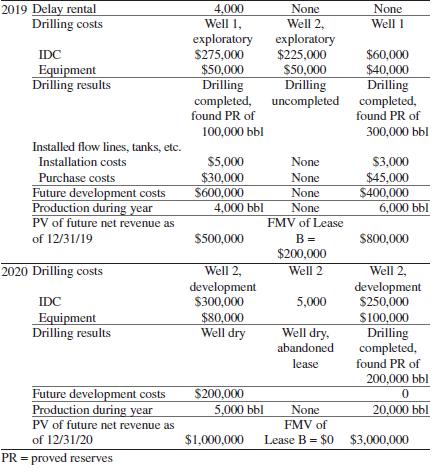

In 2018, Aggie Oil Corporation began operations exclusively in the United States. Give the entries, assuming the following transactions in the first three years of operations. Calculate DD&A twice, once assuming no exclusions and once assuming all possible exclusions from the amortization base. Ignore the ceiling test for 2018, but apply it for 2019 and 2020. Calculate the ceiling test twice for each of those years, once assuming no exclusions and once assuming all possible exclusions from the amortization base. Assume all leases are located in the United States. You may combine entries. Note that problem 23 in chapter 6 is similar to this problem. Compare these two problems to better understand the differences between successful efforts and full cost accounting.

Step by Step Answer: